What is the need for trade finance?

Trade finance – typically provided by banks and other financial institutions – is crucial to the success of a developing economy. Through services such as letters of credit for importers and guarantees for exporters, trade finance facilitates transactions, allowing businesses to buy and sell goods more easily.

However, since the global financial crisis, businesses in emerging markets have struggled to access trade finance from local banks. With increasing regulatory pressure to strengthen their capital base, banks face the choice of either refusing to extend credit to businesses – inhibiting normal economic activity – or seeking partners that can share the risk to allow the wheels of these economies to keep turning.

Over the last five years, we’ve agreed participation facilities with three banks totalling $600 million. These partnerships, which see our partners provide guarantees to local banks, mean more trade finance products can be offered to businesses in Africa and South Asia.

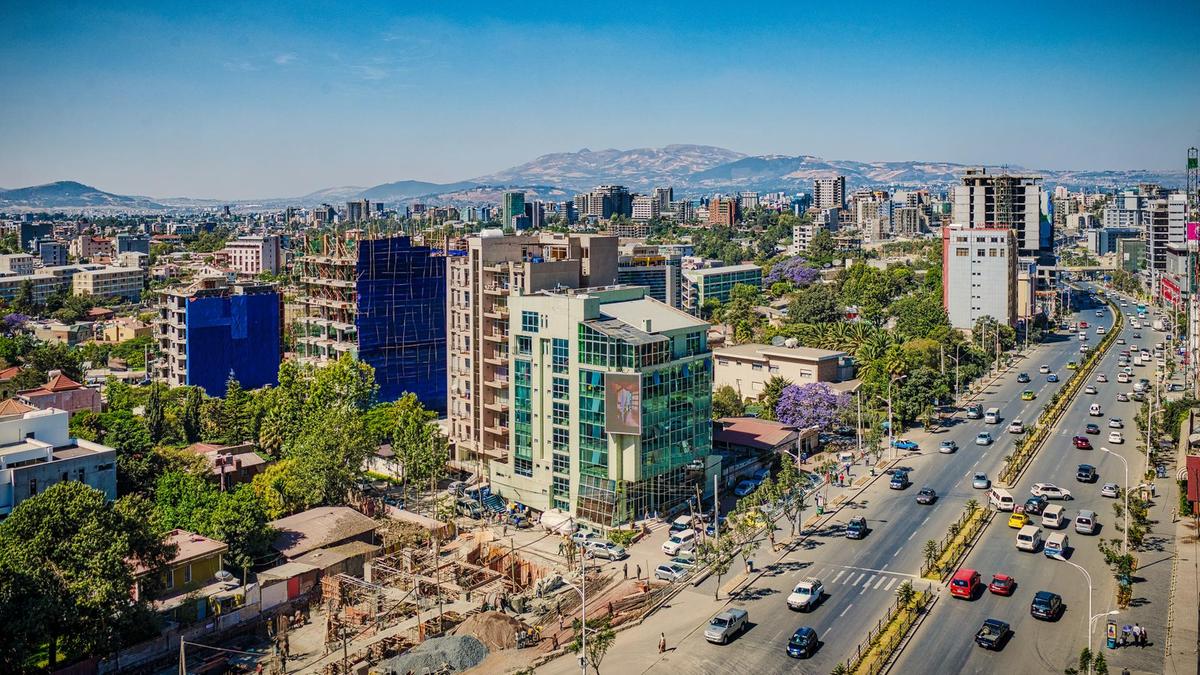

Our trade finance portfolio is currently spread across nine countries – including Nigeria, Bangladesh, Kenya, Pakistan and Ghana – whose economies are largely dependent trade. Across these countries, our programmes have supported a total of $4.15 billion of trade.

Standard Chartered

In 2013, we signed a $75 million risk participation arrangement with Standard Chartered. Following a successful introduction, the deal was extended several times in subsequent years, taking the total agreement to $400 million.

Our partnership is enabling Standard Chartered to guarantee transactions for banks operating across both Africa and South Asia – particularly in Bangladesh, where a significant proportion of our trade finance portfolio lies.

FirstRand

In 2016, we signed a $100 million risk participation arrangement with FirstRand to increase the availability of trade finance in developing countries across sub-Saharan Africa. The arrangement is supporting local banks to provide trade finance products, such as letters of credit for import, and documents against payment.

Sumitomo Mitsui Banking Corporation Europe

A year after our agreement with FirstRand we signed a similar $100 million risk participation agreement with Sumitomo Mitsui Banking Corporation Europe (SMBCE) for local banks in sub-Saharan Africa. Partnerships such as these are expected to generate over $500 million of additional trade, supporting job creation, boosting exports and enabling regional economic growth.

How it works

We always aim to be flexible in our approach, so we can provide investment products that are beneficial to the people we want to reach. With these trade finance partnerships, for example, the facilities are all developed with the needs of private sector banks in mind so that more investment reaches end users.

We’re continuing to facilitate more trade through these partnerships, which reflects their importance in the countries we operate in. Over the coming years, we are looking to grow our trade finance investments further, both through signing new programmes and providing increased support for our existing partners.