An inventive approach to achieving impact

We’ve recently committed $10 million to the SDG Outcomes Fund, the first fund dedicated to development impact bonds in lower and middle-income countries.

The fund’s goal is to back impact bonds and similar ‘outcomes-based contracts’ that support the UN Sustainable Development Goals, targeting essential healthcare, education, waste management, and employment for some of the world’s most vulnerable populations. The Fund is a partnership between Bridges Outcomes Partnerships, a not-for-profit subsidiary of Bridges Fund Management, and UBS Optimus Foundation.

Because development impact bonds are not yet a mainstream investment instrument, and still relatively new in emerging markets, our investment requires some explanation of what impact bonds are, why they’re needed, and why we at British International Investment have a role in supporting them.

$10 million

commitment to the SDG Outcomes Fund

Financial return contingent on impact

The first step is to understand the growing use of a ‘payment-by-results’ approach for donor aid provided to lower and middle-income countries.

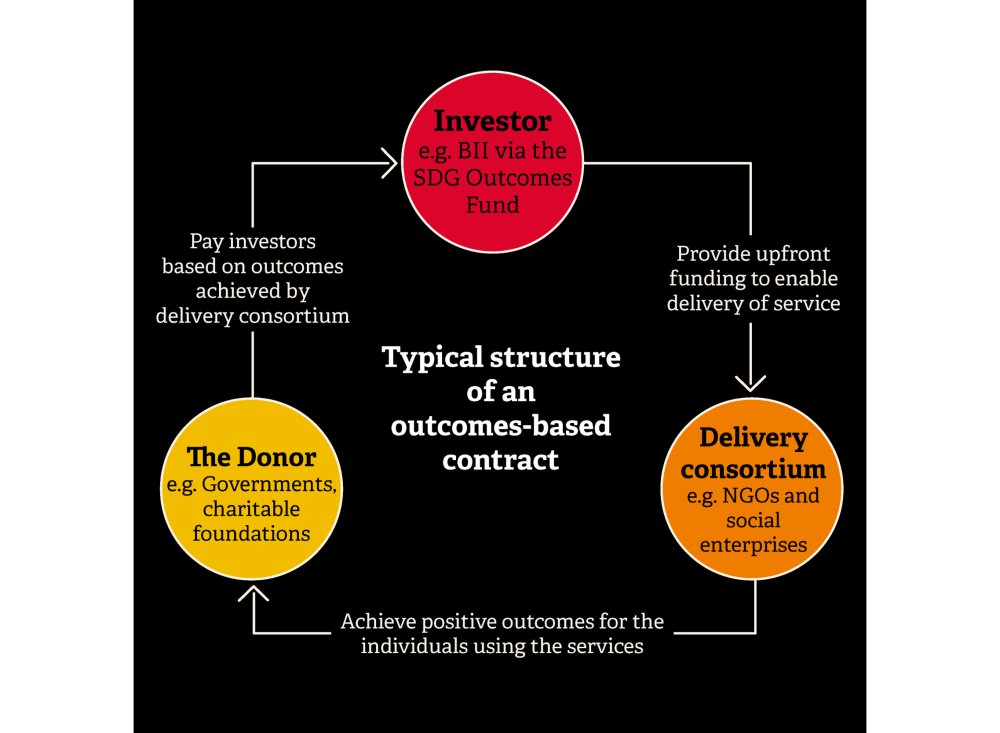

Under this approach, the payments from a donor, such as a government or development agency, to a delivery consortium providing services, such as an NGO or social enterprise, are contingent on achieving quantifiable impact.

This focus on impact is to help ensure a high quality of service provision and maximise donor spending. However, it also means delivery consortiums have an upfront capital need, as they’re required to finance the roll-out of the initial programme before any impact is generated and cashflow has begun.

And it’s that upfront need for capital that leads to the creation of development impact bonds.

Development impact bonds follow a similar model to social impact bonds, which were first launched by the UK Government in 2010 as a new way of funding public services and tackling complex social issues.

They usually involve three actors. First, the investors, who provide the upfront capital required to finance the delivery of services. Second, the delivery consortium providing these services. And third, the donor paying for the impact achieved.

Once the investor has provided upfront capital, the delivery consortium is able to deliver a service. These services create positive impact for targeted beneficiaries, and if sufficient, this impact triggers payment from the donor to the investor. So ultimately, the investor’s return is contingent on the delivery of quantifiable and measurable impact.

Bringing greater collaboration to deliver better outcomes

What are the benefits of this model? Because it’s based on all parties entering into a contract based on specific impact goals, it helps to drive greater collaboration between stakeholders, as it keeps all parties accountable for and focused on delivering better outcomes. This collaboration leads to delivery innovation, improved results and better value-for-money from existing services.

Donors benefit from the fact they pay when impact is achieved, rather than providing upfront capital for projects before they’ve achieved impact. Delivery consortiums are incentivised to deliver the best possible outcomes for service users whilst benefitting from upfront capital and financial security throughout the contract. This in turn gives them the flexibility to adapt and tailor their programmes based on a deepened understanding of what solutions deliver the best results. For investors, it provides a mechanism to support projects that go beyond just financial returns and deliver real social impact.

Impact bonds are complex and require a high level of commitment and resource from all three parties involved. Therefore, they aren’t a universal solution to donor aid or government spending. However, in the right circumstances, they are already helping donor organisations deliver impact across a range of sectors, and in different countries.

$463 million

of capital raised by impact bonds since 2010

A growing trend

Since 2010, the market for impact bonds has grown significantly, and to date, 239 impact bonds have raised $463 million of capital across 39 countries.

While only 27 of these have been in lower and middle-income countries, they have started gaining traction in these markets. Impact bonds in these countries account for a significant proportion of the total beneficiaries globally. For example, three impact bonds in India alone are seeking to serve 850,000 people. This highlights the potential of impact bonds to benefit many people in emerging markets.

27 out of 239

impact bonds have been developed in low and middle-income countries

Why a role for BII?

While impact bonds are still a new investment instrument in emerging markets, they have the potential to provide flexibility to delivery consortiums in the way funding is sourced, as well as deepen the impact achieved.

They are relevant to our role as an impact investor in emerging markets for several reasons.

First, they target some of the most challenging sectors and geographies, as well as underserved and vulnerable communities – where we’re aiming to have an impact and change lives. This means they provide us with opportunities to reach areas and communities that are a priority to us, but where it’s sometimes challenging to reach through other investment strategies.

Second, they are impact-driven, explicitly linking the investment’s financial return to the social or environmental outcomes achieved.

And third, they take an innovative approach to managing this impact. That’s because through real-time measurement of impact data, all of those involved can develop an understanding of what is working and not working. Programmes can then be adapted during delivery to maximise impact.