Click here to read Transforming lives: Five years on in full

In 2017, we set out our vision for how CDC, acting even more boldly than before, could help accelerate progress on the key development challenges facing Africa and South Asia. These were: the enormous need for jobs, driven by a rising youth population; the need to include women in securing a more prosperous and fair future; and, of course, the need to accelerate climate action in the wake of the momentous Paris Agreement in 2016.

We knew that the path ahead was difficult, but our experience over the previous five years had shown us it was full of opportunity. We had been fortunate to collaborate with some exceptional individuals and ambitious businesses across Africa and South Asia. We knew that when capital, expertise and inspiration are brought together, communities can reap exceptional benefits.

Watch some of our selected highlights from the last five years

At the same time, we knew that progress could take time, and wasn’t always linear. That has come to pass – in ways we expected, and in ways we did not. This report celebrates the achievements and lessons of the last five years, and therefore the areas we’ll be looking to build on over our next five-year strategy.

But first, we must also acknowledge the magnitude of the context we find ourselves in, just five years on. A global pandemic has triggered the worst global recession in decades. An additional two per cent of the global population has been pushed into extreme poverty, with development gains set back at least seven years. Poorer nations have vaccination rates of less than 2 per cent, hampering their ability to recover. Beyond the pandemic, the Intergovernmental Panel on Climate Change (IPCC) has recently sounded the alarm that we need to accelerate climate action to keep temperature change within 1.5°C by 2030. At the same time, 800 million people globally lack access to electricity. And some countries for which we had great hopes of political and economic progress have faltered, threatening the prosperity and security of their people.

800m

people globally lack access to electricity

Our 2017 strategy has stood us in good stead, and we’ve grown the organisation to deliver that strategy

There have been significant changes at CDC over the last five years – in the scale of our financial commitments and capabilities as an organisation. Since 2017, we’ve committed almost £7 billion ($9 billion) in long-term, impactful investments in some of the hardest places to invest in the world. In doing so, we’ve become an institution that commits on average around £1.5 billion a year and manages around £7.5 billion ($10 billion) in assets today, compared with around £5 billion (almost $7 billion) at the start of the strategy period.

Our investment mandate is challenging, so we’ve had to build our capabilities to achieve this scale. We’ve grown from a team of around 220 people in 2017 to around 500 in 2021, all of whom are committed to achieving the best possible development impact.

Over this time, we’ve been a proud part of the UK Government’s offer to support developing and emerging economies. That includes working closely with the UK Government in the countries where we invest and building partnerships with British businesses that operate in these countries. We will build on this work in the next strategy period.

Our additional capabilities have allowed us to deliver in several areas.

£7bn

Since 2017, we've committed almost £7 billion ($9 billion) in long-term, impactful investments

We've become more focused on impact than ever before

This includes building our team of over 70 impact professionals, who are now a key part of our investment selection and management process. With this enhanced expertise, we ensure that impact is built into every investment decision, shifting our focus to the sectors where we can have the greatest development impact, and adopting key standards and principles for impact. This greater emphasis is leading to real change: our Investment Committees are interrogating the impact of each potential investment, we’re making different investment decisions than we did before, and we’re better at managing impact once we’ve invested.

This greater impact focus has also seen us lead the way on gender-smart investing and develop an ambitious approach to tackling climate change, committing to align our investments with the Paris Agreement and achieve a net-zero portfolio by 2050.

70+

We've grown from fewer than 20 to over 70 impact professionals

We’ve sharpened our regional focus on Africa and South Asia

This has meant having a greater staff presence in both regions, from three countries in Africa and South Asia in 2017 to an additional eight countries today. This presence has been key to building networks and supporting our investee companies. Within those regions it’s meant further changes too – for example, in South Asia we’ve moved from an India-focused portfolio to one that incorporates countries including Pakistan, Bangladesh, Nepal and Myanmar. Our investments in these countries range from renewable energy businesses to a leading microfinance institution enabling more than a million low-income families to improve their standard of living.

They also include an internet service provider, connecting hundreds of thousands of households and small businesses to the internet. In addition, these investments have allowed us to refine our thinking on, and approach to, achieving impact in fragile and conflict-affected states.

£4bn

Since 2017, we've committed around £4 billion of investment in Africa

We’ve embraced our goal to become more innovative

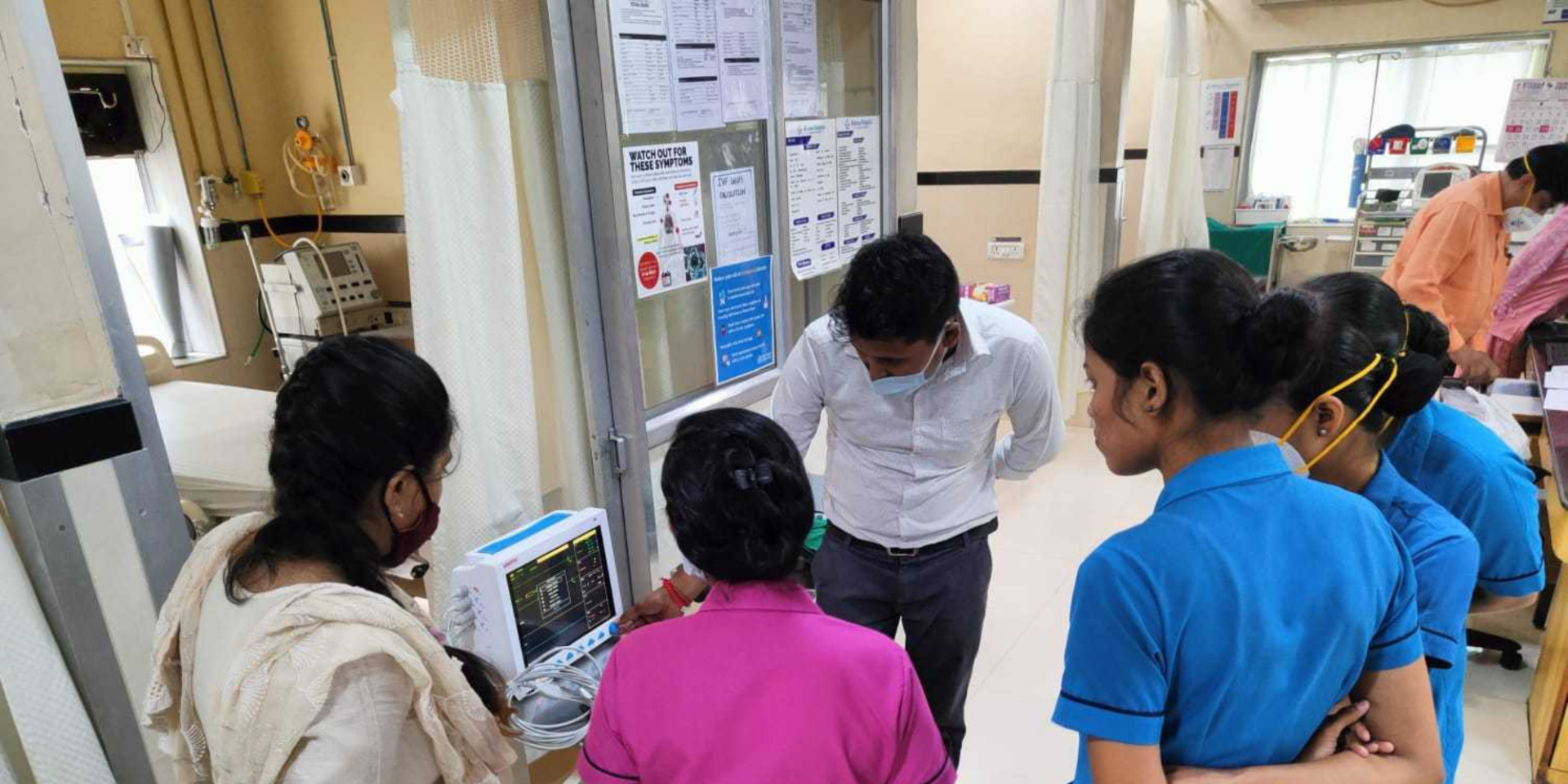

This has meant expanding the pioneering work of our Catalyst Strategies, which we announced in 2017. These strategies allow us to take an even more flexible approach to risk in pursuit of impact, and have led to market-shaping investments. Through these strategies, we’ve built new companies – such as MedAccess, which provides innovative social finance to secure life-changing medical supplies for people in Africa and Asia, and Gridworks, which is addressing the under-investment in electricity transmission, distribution and off-grid infrastructure in Africa.

Being more innovative has also involved introducing new tools to our toolkit. These include CDC Plus, which provides technical assistance, and a significant expansion in our trade finance and supply chain finance programme. As we become more innovative, we’re also more openminded about changing our approach. For example, investing in technology wasn’t identified as a priority in 2017, but we now firmly believe it has a strong role to play in finding sustainable and inclusive solutions to reach the Sustainable Development Goals (SDGs). This ranges from improving access to affordable, good-quality internet that is central to development, to providing solutions that have the potential to make a difference to both people and planet. So, alongside large investments in companies such as Liquid Telecom to build broadband infrastructure across Africa, we’ve also recently introduced a venture capital programme to support exciting, young companies that have the potential to provide fresh perspectives in meeting old challenges.

This includes companies like Loadshare, an Indian logistics company that uses technology to bring together small and medium logistics companies, enabling better market access, which boosts their growth and creates jobs.

Of course, given the challenging nature of what we do, not everything has gone to plan. The reality is that, from time to time, some of our investments will fail. All investors face this risk, and for us, as an institution investing in some of the most challenging environments, the risk is higher. That’s the nature of the development finance business.

Each failure is disappointing and unwelcome, but they are expected, learnt from and acceptable within our risk profile, as long as we remain on track to achieve the portfolio-level commitments on long-term financial returns we’ve made to our shareholder.

10m

CDC Plus-funded investees and projects have affected over 10 million people in our markets

Finally, we've learnt from our experiences

When the Independent Commission for Aid Impact (ICAI) first reported on us in 2019, one of its conclusions was that we needed to do more to learn from our investments and to share these lessons. They were right. We’re pleased with how we’ve taken on board that feedback and scrutiny, and we were delighted when ICAI’s recent report pointed to CDC as an example of “a positive learning journey” that brought about “strong results” and “impressive improvements”.

As we look to move to a new strategy period in 2022, it’s this culture of learning we intend to build on. We continue to have many of the same objectives we had ten years ago,

but we now have the benefit of greater experience of what works and what doesn’t. We are incredibly proud of our achievements since 2017, and we know there is still much more to do. Our mission to help solve the biggest global development challenges by investing patient, flexible capital is an ambitious one – and the markets in which we invest need our support now more than ever.

To be successful, it’s important we don’t stand still. As we embark on our next strategy, we will continue to uphold our long-term values and goals, while refining our approach to find the best ways to support the businesses and countries where we invest.