INDIVIDUAL(S) PHOTOGRAPHED: N/A. LOCATION: Akpakpava Road, Benin City, Edo State, Nigeria. CAPTION: A traffic light counts down to green within the city of Benin.

Markets in Africa during the first half of 2018

This article provides a snapshot of what’s been happening in the markets in Africa we invest in during the first half of 2018. It draws on data and analysis from CDC, as well as the thoughts of people we work with on the ground on the continent.

By Adam Fegan and Taylor Ruan.

Macro environment

Growth showing signs of recovery

Economic growth in sub-Saharan Africa was badly affected by a fall in commodity prices in 2016. That year, growth was just 1.1 per cent, before increasing to around 2.6 per cent last year. This modest upward trajectory is set to continue into 2018, supported by a rebound in commodity prices and the further development of trade in the region. The Economist Intelligence Unit (EIU) estimates that real GDP growth in Sub-Saharan Africa will increase very slightly to 2.9 per cent (Table 1).

Keep a close eye on political developments

Political developments on the continent continue to have a major impact on macroeconomic performance and the operating environment for our investments. There are several areas we are closely monitoring:

In Kenya, the political situation is stabilising following last year’s disputed general election – we would anticipate that the increased stability may lead to improved investor confidence. Whilst in Ethiopia, tensions have reduced following the appointment of Abiy Ahmed as prime minister, which could galvanise the economy.

In central Africa, further political instability in the Democratic Republic of the Congo could have ramifications beyond the giant country – investors in the nine nations that border it will also be keeping a close eye on the situation. Nigeria is another country to look out for. The general election is being held next year, so we’ll likely see decisions on policy and government spending made in 2018, in an attempt to secure votes before people go to the polls.

Further south, in Zimbabwe, election closure has been delayed as Emmerson Mnangagwa’s victory in the general election is being challenged in the country’s constitutional court. In the short term, this uncertainty is putting off investors. Nevertheless, in the long run, we see potential for the country as more investors start to look at opportunities there, as the political situation stabilises.

Table 1: Sub-Saharan Africa economy: Forecast summary

| Real GDP growth (%) (market exchange rate) | ||||||||||

| 2013A | 2014A | 2015A | 2016A | 2017A | 2018F | 2019F | 2020F | 2021F | 2022F | |

| SSA | 4.7 | 4.5 | 3.0 | 1.1 | 2.6 | 2.9 | 3.0 | 2.9 | 3.6 | 3.9 |

Private equity market

Fundraising continues to be a challenge

In some ways 2017 was a difficult year for fund managers on the continent, with sub-Saharan Africa-focused fundraising falling by around 38 per cent on the previous year. Although there have been one or two notable exceptions – A. P. Moller’s Africa Infrastructure Fund, for example – the general trend has continued into this year. The decline has been especially pronounced in buyout and growth capital, as the appetite from strategic buyers for private equity-backed companies in Africa has waned due to stumbling regional economies and longer holding periods.

Deal flow slowing

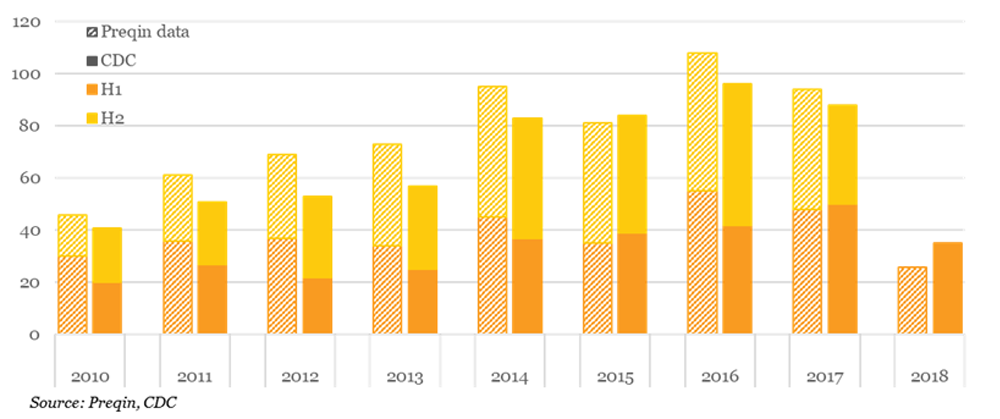

With regards to deal flow, we’ve compared our data with available information from intelligence provider Preqin, and we’ve found that deal flow in the first half of the year fell by 46 per cent when compared with H1 2018 (as shown in Figure 1). This is the lowest semi-annual depreciation since 2011.

South Africa, which has for so long been a driver of investment activity on the continent, saw investment decline significantly, according to Preqin. This is likely caused by the cyclical downturn in fundraising activity, exacerbated by the challenging economic and political environment in the country.

Throughout H1 2018, we’ve continued investing in African companies both through direct and intermediated equity. Although the investment pace has been affected by the deal flow decline and fundraising challenges, we have made more investments than those provided by Preqin. In fact, CDC was in almost all the African fund closes that happened in H1 2018.

Figure 1: Deal flow in Africa by count: Preqin data vs. companies invested by CDC – 2010 to H1 2018

Public market

Prepare for short term currency depreciations

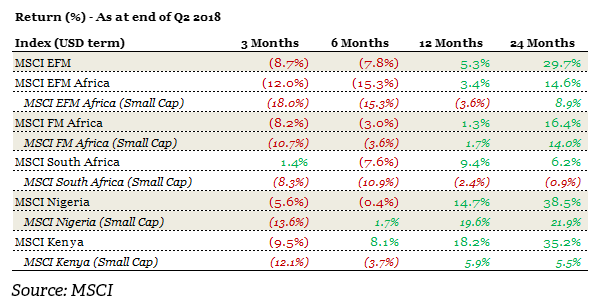

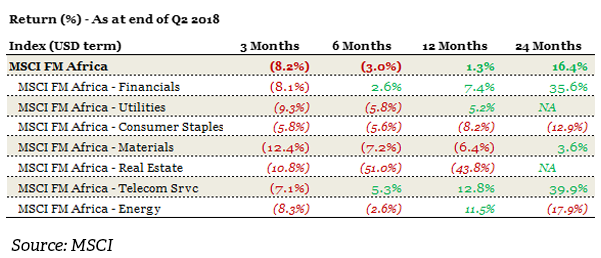

The MSCI indices (Table 2 and Table 3) show that the African equity market declined in H1 of this year. This was, in part, caused by the US dollar appreciating in value against major African currencies, brought about by the US Federal Reserve’s move towards a tighter monetary policy.

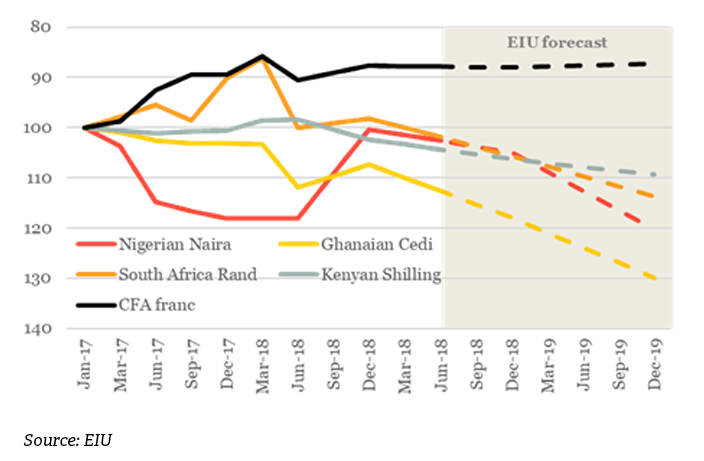

Currency risk remains a challenge. Looking ahead, expect to see major African currencies depreciate in the short term, except for the CFA Franc (used in some central and western African countries) – this is shown in the EIU’s forecast (Figure 2). As a US dollar-denominated investor, the performance of our investments can be discounted by such currency depreciation.

Table 2: MSCI returns by region/ country (%) – as at the end of June 2018

Table 3: MSCI FM Africa return by sector (%) – as at the end of June 2018

Figure 2: Currency movements – rebased at 1 January 2017