Nearly half of the global population remains unconnected to the internet, and many more are poorly served. Globally, ICT is one of the fastest growing sectors and contributes roughly 16 per cent to GDP. Yet GIIN estimates that only 3 per cent of impact investments in emerging markets are in the ICT sector.

Five years ago, when we began to look at the potential to scale-up CDC’s investments in ICT we were struck by the lack of impact investors making large investments in the sector. Since then, we have invested almost $500 million into ICT.

This includes backing companies like Liquid Telecom and WorldLink, which are having a huge impact by bringing broadband to some of the most isolated places across Africa and Nepal respectively.

Liquid Telecom, Africa’s largest independent fibre, data centre and cloud technology provider, has successfully activated the first national fibre network in the Democratic Republic of the Congo. This is estimated to add 0.8 per cent to the country’s GDP and raised $820 million in debt financing, mostly on public markets. The company demonstrates the vast potential for ICT businesses to achieve financial success as well as meaningful impact.

Looking ahead we forecast that the Global Partnership for Ethiopia, the country’s first private mobile operator, will provide approximately 24 million Ethiopians with access to inclusive digital services for the first time. Established by a consortium of Vodafone, Safaricom, Vodacom, Sumitomo and CDC, the company will reduce the price of connectivity for customers by up to 75 per cent by 2032.

Our ICT portfolio now represents 6 per cent of all ICT impact investments in emerging markets, and while we are proud of what we have achieved we want to see more impact investors joining us in the sector. There certainly is no shortage of opportunities.

We have learnt a lot over the course of our investments and in the process we have also encountered several misconceptions about the sector which are holding back other investors.

First, many impact investors fail to recognise that today ICT is just as important as traditional high priority sectors, such as energy and financial services for driving economic development, which comprise more than 50 per cent of impact investments in emerging markets. Like these, ICT is a fundamental building block of a modern economy and indispensable for business growth.

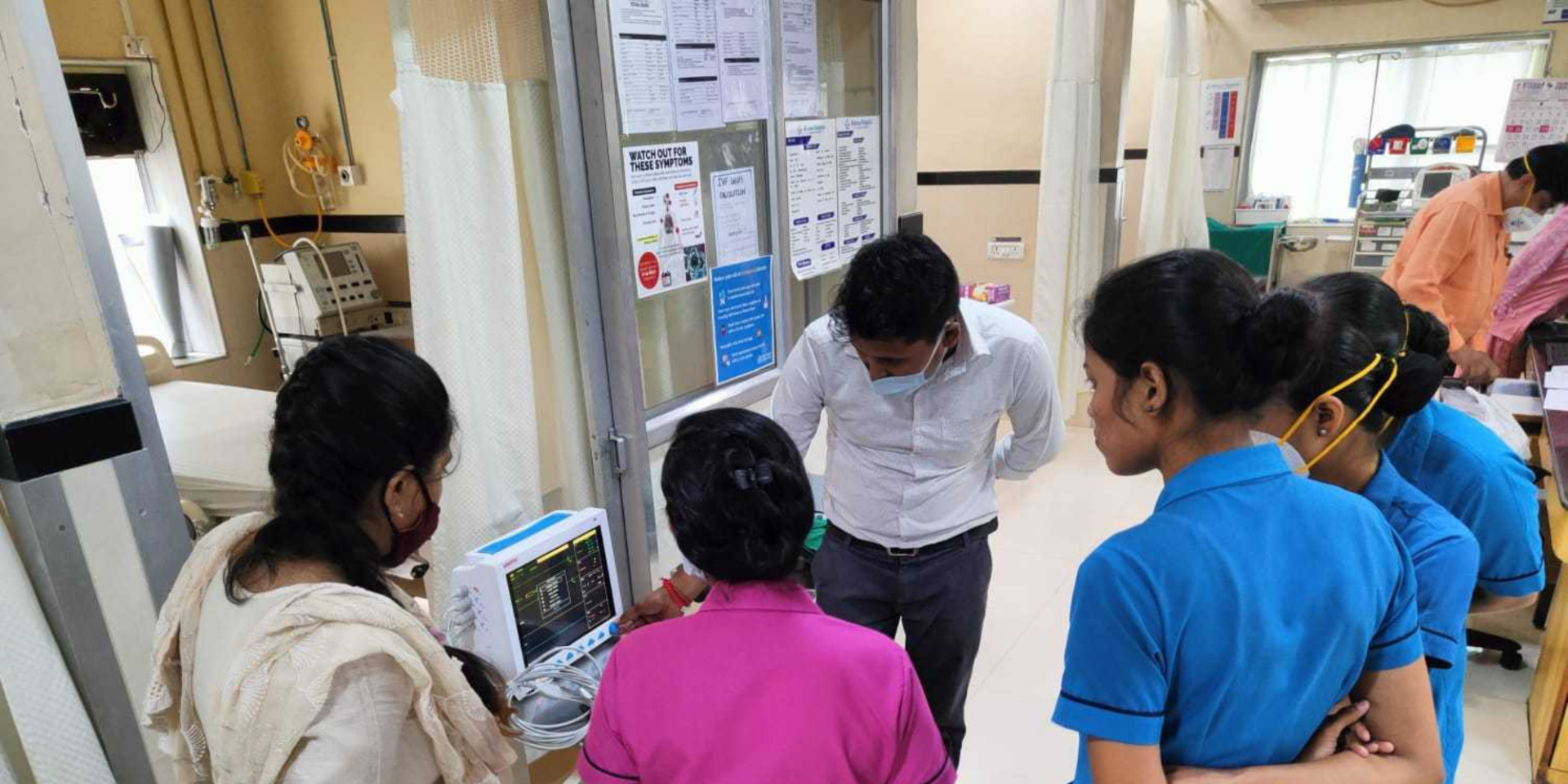

For example, in Africa, the arrival of undersea cables to boost internet connectivity enabled job growth by 4 – 10 per cent over the past decade. In addition, evidence indicates connecting an additional 10 per cent of a population to the internet leads to a 1.4 per cent growth in GDP, and that digital services drive better social outcomes. We know connectivity means increased access to education, healthcare, banking and government services, all essential for development.

Second, there is a misconception that there is no need for impact capital in the sector as it can be fully funded by the private capital. However, in the telecoms industry, the growth of the internet has led to sharp reductions in traditional revenues forcing business restructuring on top of significant infrastructure changes.

These pressures mean that investments which were traditionally made by mobile operators are now made by independent businesses. In emerging markets, it is often impact investors who seed the first of these businesses, shown by the creation of Helios Towers a holding company under which sits country-specific telecoms operating companies.

Third, investors are put off from investing in ICT companies as they often require large equity investments. Many impact investors in emerging markets choose to reduce risk through smaller tickets and debt structures. Debt and equity-like debt comprises 63 per cent of impact investments . However, such de-risking is less necessary as many ICT segments have a more conservative risk/return profile akin to infrastructure investments, as opposed to traditional growth equity investments.

The opportunity to back some of the most exciting and impactful companies in the ICT sector never fails to excite us at CDC and we believe there are many more opportunities for impact investors looking to make a real difference to people’s lives. We encourage our fellow impact investors to invest more alongside us to help grow the pivotal ICT sector in emerging markets.