- BII’s commitment is part of a $295m loan package led by FMO to the leading Nigerian bank.

- The funding will strengthen Access Bank’s capital base and allow it to support SMEs, including women and youth, to improve their access to finance.

- It will help to stimulate business growth, create more jobs, and deepen financial inclusion in Nigeria.

British International Investment (BII), the UK’s development finance institution and impact investor, today announced a $50 million commitment to Access Bank as part of a $295 million loan package arranged by FMO. The funding will strengthen Access Bank’s capital base and allow it to support underserved Small, and Medium Enterprises (SMEs) including those led by women and youth, providing access to working capital and supporting resilience as Nigeria faces its most severe economic crisis in a generation.

Access Bank is one of the largest banks in Nigeria, that is committed to providing support to businesses through funding, capacity building and networking opportunities. Since 2018, BII has provided direct and indirect investments to the bank supporting its ambitious expansion plans in Africa.

There are nearly 40 million MSMEs in Nigeria, accounting for 86 per cent of employment and contributing 50 per cent to the GDP [1]. Despite their importance to the Nigerian economy, many SMEs businesses face challenges with accessing finance. The commitment from BII will help to strengthen Access Bank’s capital reserves and provide much needed working capital and financing to Nigerian SMEs across various sectors including agriculture. This will help to stimulate business growth, create more jobs and deepen financial inclusion in Nigeria, which is the most populous country in Africa.

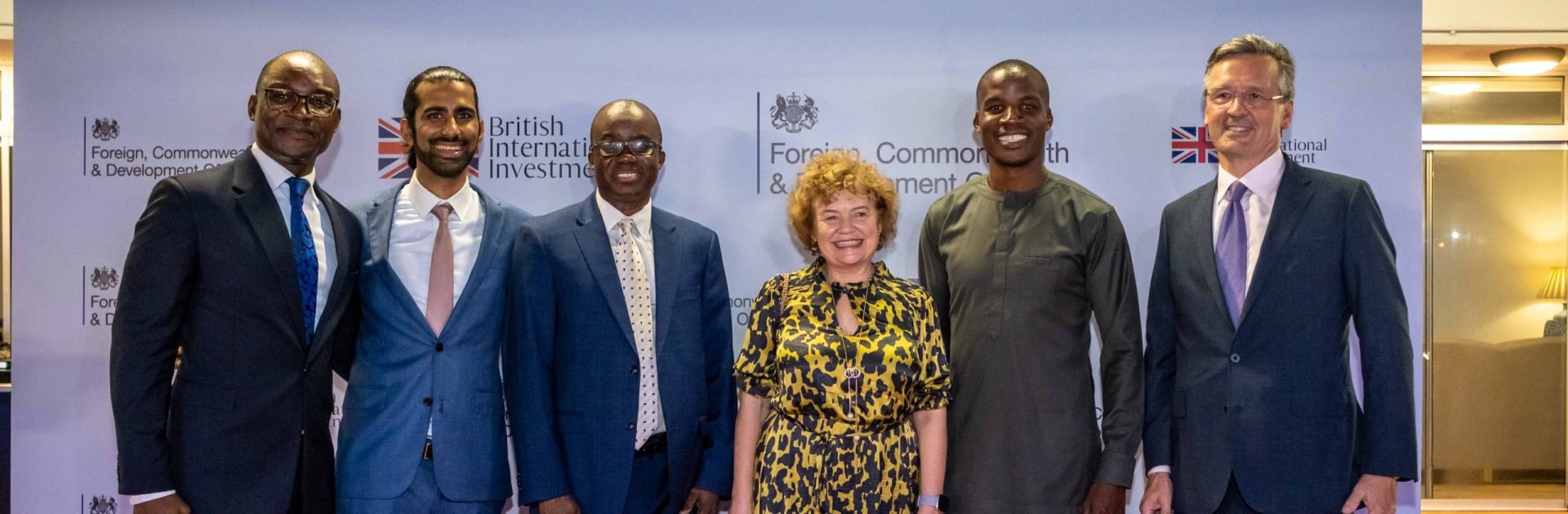

Jonny Baxter, British Deputy High Commissioner, said: “When smaller businesses and women entrepreneurs are economically empowered, their whole community benefits. That is why the UK is providing new support with Access Bank to help businesses in underserved communities access finance to scale up their operations, create jobs and grow the economy. It also shows our commitment with the Nigerian Government to deepen our economic co-operation, boost growth and development opportunities across our countries.”

Benson Adenuga, Head of Office and Coverage Director, Nigeria at British International Investment, said: “As a counter cyclical investor, we are proud to deepen our partnership with Access Bank to accelerate Nigeria’s recovery and empower businesses playing a pivotal role in the creation of jobs, innovation and economic diversification. By supporting the ambitions of SMEs including women and youth-led businesses, we can ensure a more inclusive and sustainable future for Nigeria.”

Roosevelt Ogbonna, Managing Director/Chief Executive Officer of Access Bank Plc, commented: “Today marks a significant milestone in our longstanding partnership with FMO, the Dutch Entrepreneurial Development Bank. This monumental syndicate Tier II Facility agreement underscores the deep-rooted trust and synergy between our institutions.

This facility not only enhances our capital reserves but also strengthens Africa’s trade capabilities and export potential. Putting these funds to use, we aim to catalyse growth across various sectors, stimulate business development, create jobs, and deepen financial inclusion, aligning with Access Bank’s mission to drive progress and development throughout the continent and beyond.”

In addition to FMO, BII is joining seven other development finance institutions (DFIs) and impact investors, including BIO, Blue Orchard, FinDev Canada, FinnFund, Norfund, Oikocredit and Swedfund.

This commitment contributes to the United Nations’ Sustainable Development Goals 5 and 8, on Gender Equality, Decent Work, and Economic Growth.