- BII has been a partner to South Africa since 1995, backing 150 businesses across the country since then; current portfolio stands at $285 million.

- BII companies in South Africa have created 54,500 jobs a year since

- BII hails role of technology and digital transformation in South Africa to address inequality and accelerate growth.

- BII’s clean and renewable energy investment strategy aligns with the South African’s government energy priorities, announcing new investment in 140MW South African wind farms.

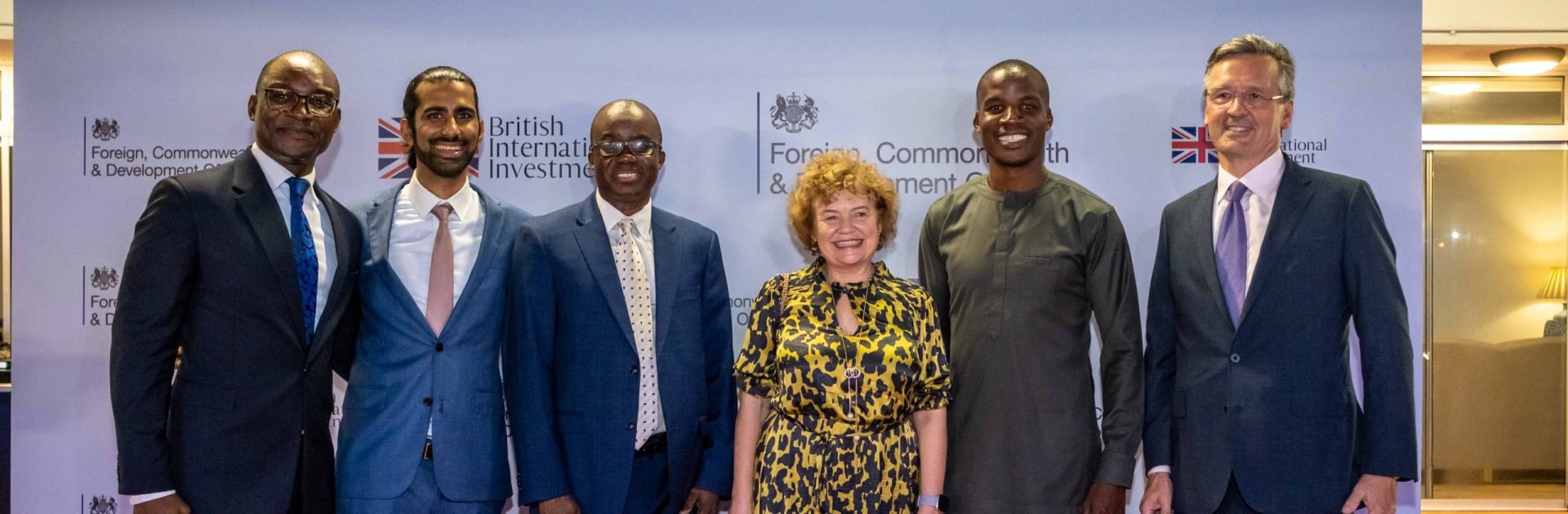

British International Investment today announced a ZAR125 million ($6.7 million ) investment in two 140MW wind farms in the Northern and Eastern Cape of South Africa. The new funding was trailed at a business reception in Cape Town hosted by BII and the UK’s development finance institution (DFI) and impact investor, while they celebrated 75 years of investing for impact in Africa.

This is part of a three-project cluster co-developed by H1 Capital and EDF Renewables. Currently under construction, the two wind farms are expected to reach completion in 2024 and will provide clean, affordable energy to South Africa.

BII has invested in at least 150 South African businesses since 1995, amounting to over $2bn committed to South Africa, and its portfolio companies have supported over 54,500 jobs a year since 2014. By the end of 2022, BII’s portfolio value in South Africa had expanded to approximately $285 million.

South Africa faces a severe energy crisis, which affects the safety and productivity everyday life. In 2022, electricity cuts averaged eight hours per day. Outages experienced by South Africa cost the continent 2- 4% of its gross domestic product annually, according to the findings of the AfDB study.

Supporting a just energy transition, BII’s has partnered with H1 Holdings, a South African Broad-based Black Economic Empowerment(BBBEE) renewables investment and development company, and Scatec to launch three solar and battery storage facilities in Kenhardt under South Africa’s Risk Mitigation Independent Power Producer Procurement Programme (RMIPPPP).

Its backing of strategic energy platforms including Globeleq, Gridworks, ACWA and Redstone demonstrate the UK’s focus on actively helping economies to reduce emissions and maximise the delivery of consistent and clean power to South Africa’s cities, villages, townships, businesses and farms – providing a major boost to productivity and economic growth.

BII also hosted a gathering for the African venture capital community, Innovation for Impact, in Cape Town. The event brought development finance institutions, investors, fund managers, multinational corporations, venture capital firms, start-ups and founders together to advance the use of African venture capital in combating key development challenges and deepening collaboration across Africa and South Asia.

BII recognises that investing in digital infrastructure, digitally enabled businesses and tech-led innovation can have a disproportionately positive effect in addressing key development challenges. Particularly in South Africa where the digital gap is significant with broadband in only 10% of households. The DFI has partnered with South African-based Liquid Intelligent Solutions which has 100,000km of fibre network in Africa, and Tyme Bank, South Africa’s leading digital bank that brings crucial banking services to the underbanked populations.

Digitalisation also advances climate technologies with renewable power, such as solar, wind, and battery energy storage systems (BESS). Marking its commitment to meaningfully increase energy access, last year, nearly half of BII’s investments were in climate finance, valued at £591m.

Nick O’Donohoe, BII CEO, highlighted the DFI’s special relationship with South Africa and reiterated BII’s ambition to help solve pressing development challenges in South Africa including reliable clean energy.

Commenting on BII’s long-term commitment to partner with promising businesses and ambitious entrepreneurs in South Africa, Nick O’Donohoe, CEO, BII said: “We committed over $5.5 billion to Africa in our last five year strategy period. BII’s strategic objective in South Africa is to invest its patient, long-term capital to continue to meet the needs of those whose mission and purpose strive for equality, inclusive economic growth and a more sustainable future.”

British High Commissioner to South Africa, Antony Phillipson said: “The work the UK is doing with BII to help grow businesses in South Africa and in turn create thousands of local jobs, is absolutely fundamental in supporting our shared ambition with South Africa to build an inclusive, sustainable future for all.”

ENDS

Notes to editors

Media contact

British International Investment: Clare Murray | press@bii.co.uk