- Investment is the third time BII has backed an Apis fund

- Fund manager has a proven track record in backing fintech entrepreneurs

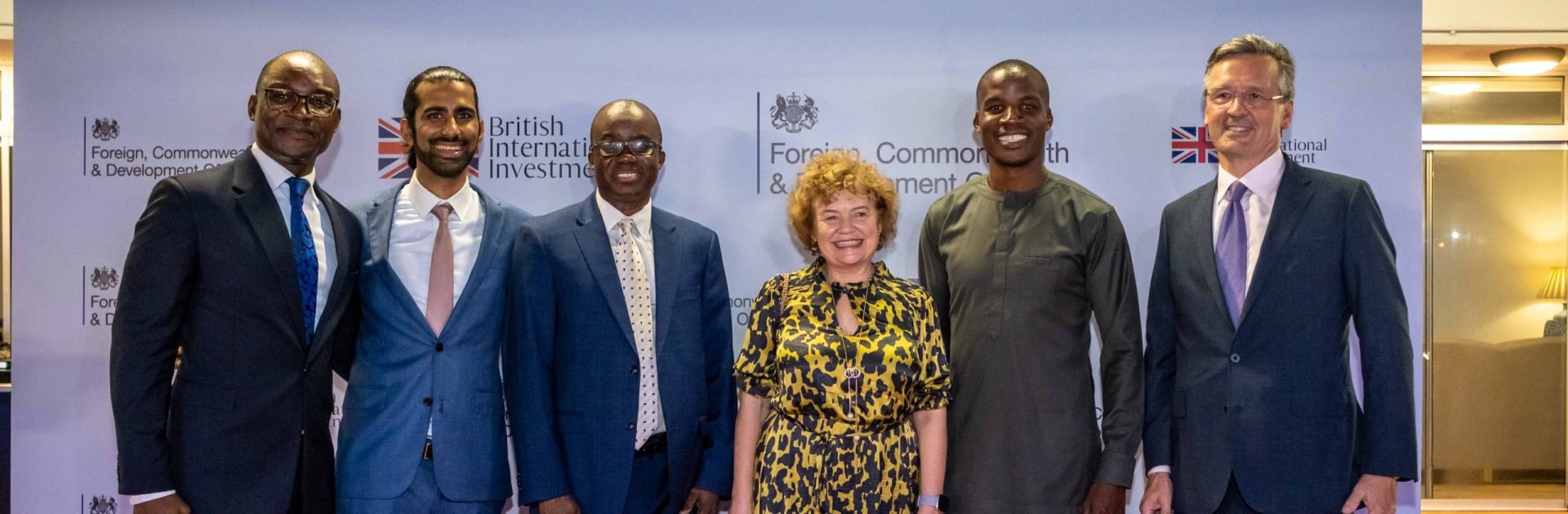

British International Investment, the UK’s development finance institution and impact investor, today underlined its support for fintech entrepreneurs with a $40 million commitment to a new Apis fund – the Apis Growth Markets Fund III (“Apis III”). Apis Partners LLP (“Apis”) is a UK-based private equity firm investing exclusively in high-growth, capital-light, tech-enabled financial services businesses globally.

It is the third time BII has backed an Apis fund. The partnership between BII and Apis dates back to 2015, when BII anchored Apis’ first fund with a $30 million commitment. It continued in 2019 with a $50 million to Apis’ second fund.

Apis specialises in investing in digital financial services companies, particularly those involved in payment and credit services.

Digital infrastructure is a vital pillar to support economic growth in the emerging economies in which BII invests.

Dalia Aga-Shaw, Director and Head of Financial Services Funds at BII, said: “Apis has a proven track record of delivering impact by supporting the fintech sector. This new fund will provide vital capital to entrepreneurs as well as large businesses. The provision of services by Apis’ investee businesses will boost low-income households and create wider economic opportunities.”

The latest BII investment in Apis supports Sustainable Development goal 8.10 – improved economic opportunities for consumers and businesses via an improved ability to manage liquidity, investment and risk.

BII’s commitment to Apis III will help Apis to reach its target fund size and comes at a time when there is reduced demand for emerging market fintech businesses among commercial investors.

BII has been a key advisor to Apis since backing its first fund and has played a crucial role in developing ESG and BI standards at the fund manager as well as strengthening its impact management capabilities.