- This is BII’s first investment in South-East Asia under the current 2022-2026 investment strategy.

- BII expects to provide up to £500 million of climate finance in the region over the coming years.

- This fund commitment contributes to BII’s target of 30 per cent of total new commitments in climate finance.

- BII’s investment is expected to attract more capital to help key countries including Indonesia, Philippines and Vietnam to achieve their clean energy goals.

British International Investment (BII), the UK’s development finance institution and impact investor, announced a $15 million commitment to the SUSI Asia Energy Transition Fund (SAETF), a South-East Asia-focused energy transition infrastructure fund managed by Swiss-based firm SUSI Partners. This is BII’s first commitment in South-East Asia following its plan to re-enter the region and provide the investment capital needed to boost clean and sustainable economic growth and support the region’s green energy transition.

With this commitment, BII joins other development finance institutions, including AIIB, FMO, Swedfund, Norfund, and OeEB, as well as private investors in backing SAETF. The investment marks the start of realising BII’s ambitions to invest up to £500 million of climate finance in the South-East Asia region and forms part of its overall goal to target 30 per cent of total new commitments to climate finance.

SAETF targets infrastructure investments across the energy transition spectrum, including renewable energy, energy efficiency, and energy storage projects, and focuses on emerging economies in South-East Asia, including Indonesia, Vietnam and Philippines. The Fund will contribute to global climate mitigation goals and the Paris Agreement by financing clean energy solutions, increasing the supply of reliable and affordable electricity for businesses and consumers, and enabling access to clean energy solutions in underserved areas.

South-East Asia has been one of the fastest-growing regions in the world. While the countries are in various stages of development, almost all their economies have more than doubled in size since 2000. This means that energy demand in the region has increased on average by around three per cent a year over the past two decades.[1]

To address this growing energy demand and reduce dependence on fossil fuel generation, six South-East Asian countries, including Indonesia and Vietnam, have announced net zero emissions and carbon neutrality targets. These sustainability ambitions require at least $200 billion of energy sector investment by 2030, of which over three-quarters needs to be channeled into clean energy.[2]

Consequently, BII’s investment is also aimed at attracting further commercial investors to unleash climate finance opportunities and support green, resilient economic growth in the region.

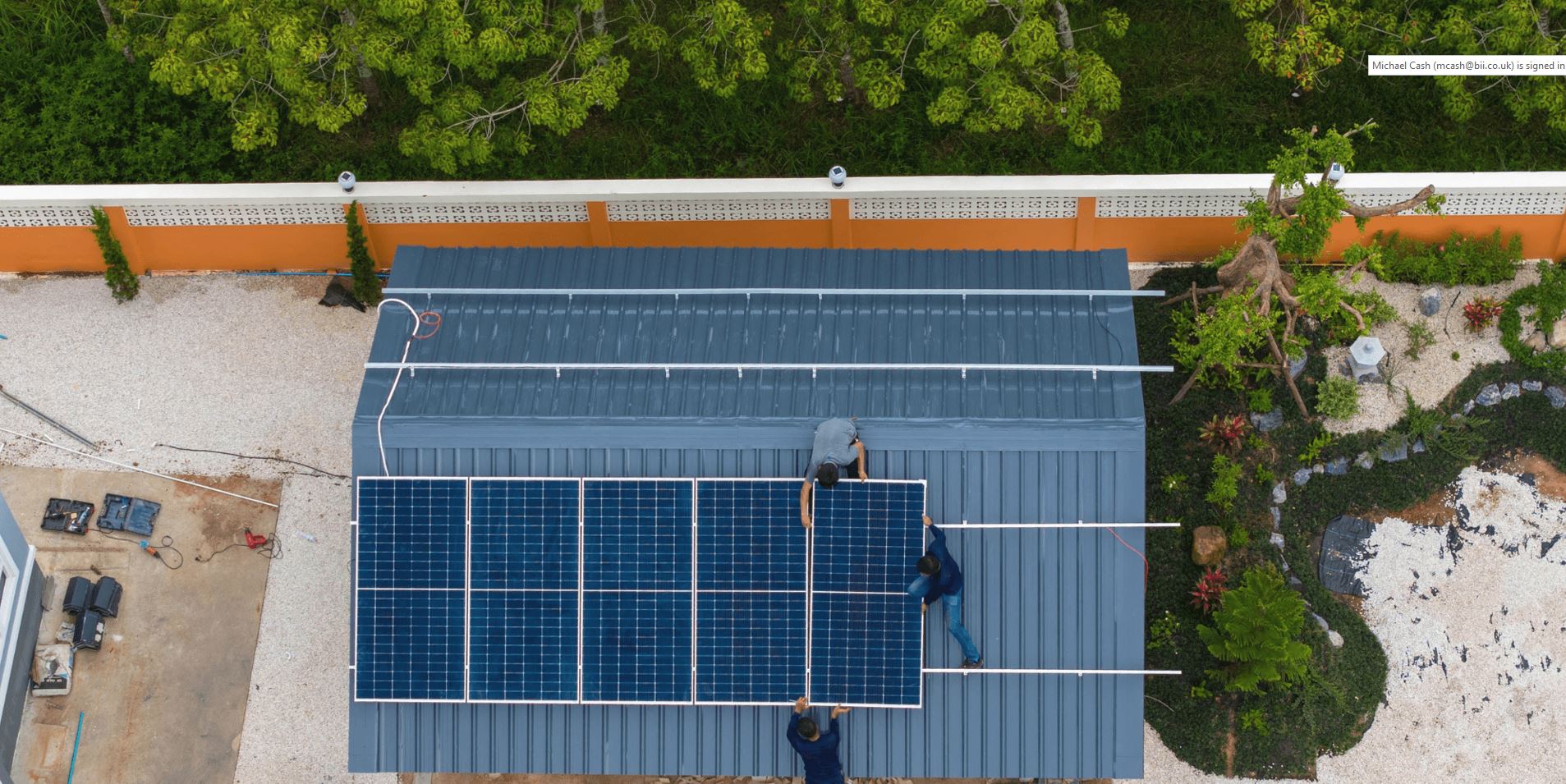

With SUSI Partners, SAETF enlists the expertise of a specialised investment manager with a proven track record of investing globally across the energy transition infrastructure spectrum. The firm has already made four investments on behalf of SAETF, including three joint ventures dedicated respectively to the buildout of rooftop solar photovoltaic (PV) assets with Singapore-based Entoria Energy; financing and operating energy efficiency projects with Malaysian company InvestEnergy across South-East Asia, and development of utility-scale renewable energy projects with regional developer Pacific Impact in Indonesia, Vietnam, Philippines and other South-East Asia markets. More recently, they announced an investment in Asia Clean Capital Vietnam, a solar developer for commercial and industrial customers in Vietnam. The investments support BII’s renewed approach to investing in climate finance in South-East Asia.

Wymen Chan, Head of Asia at SUSI Partners, said: “Energy demand in South-East Asia is growing fast in line with the region’s economic development. Our goal is to direct capital towards the buildout of infrastructure that allows this growth to occur in a sustainable manner while proving that South-East Asia is not just an impactful but a highly attractive market for public and private investors alike.”

Kara Owen, British High Commissioner to Singapore commented: “South-East Asia is a region that is critical to our global climate objectives. It is home to major emitters that need investment to deliver on their international climate commitments, and many countries that are very vulnerable to the effects of climate change. Following the launch of its new HQ in Singapore nine months ago, I am pleased to see British International Investment delivering concrete spend supporting the Indo-Pacific region. This is part of the UK’s strong and continuing commitment to increasing access to climate finance for green infrastructure and promoting green economy cooperation.”

Srini Nagarajan, Managing Director and Head of Asia at BII added: “We have been investing across Asia for over 30 years. SAETF is an excellent re-entry point for BII into South-East Asia and a clear statement of our ambition to provide climate finance and support innovation to meet the challenges from the climate crisis. We laud the region’s climate ambitions and look forward to collaborating with SUSI’s local teams to further develop scalable and bankable sustainable projects.”

The commitment from BII will contribute to the United Nations’ Sustainable Development Goals on Affordable and Clean Energy (SDG 7), Decent Work and Economic Growth (SDG 8) and Climate Action (SDG 13).

ENDS

Notes to Editors:

British International Investment media contact: press@bii.co.uk

[1] ASEAN Renewables Challenges and Opportunities by International Energy Agency and Imperial College London

[2] Southeast Asia Energy Outlook 2022 by International Energy Agency