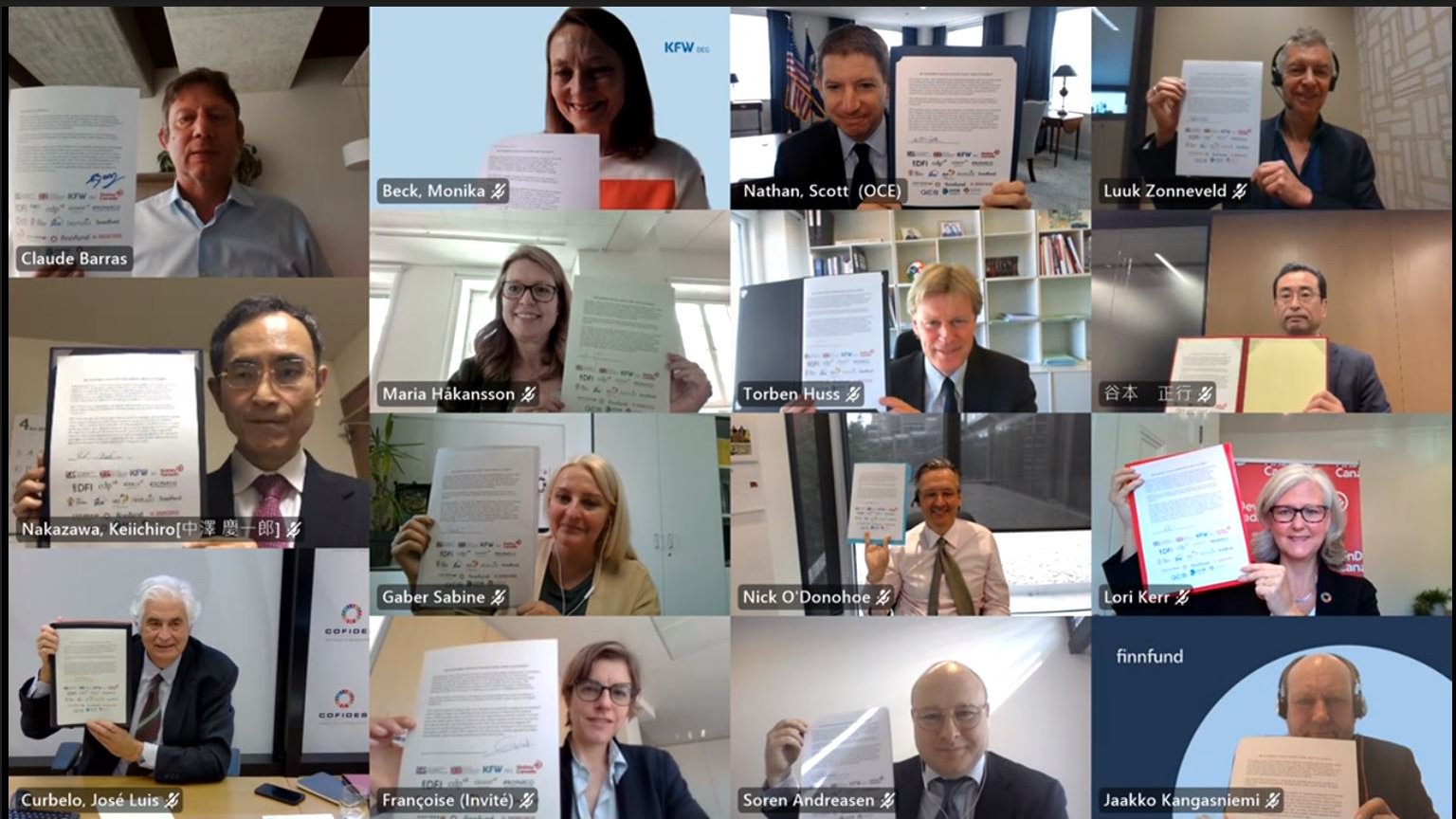

On 15 May, the 15 members of the Association of European Development Finance Institutions (EDFI) gathered for their Annual Meeting and launched a new initiative to deepen cooperation on responsible financing requirements and impact measurement. The European DFIs jointly manage a portfolio of app. $50 billion of impact-oriented investments in emerging and frontier markets. They will work on an accelerated time schedule towards common definitions and methods to measure impact on SDGs, with a focus on key impacts to which private sector enterprises contribute, including gender equality, job creation, reduced inequality, and fighting climate change.

There are currently many different approaches to measuring the development impact of investments in countries where the needs are greatest. Harmonising these approaches will give a clearer picture of the actual progress. This type of professionalisation is needed to bring more private investors into the impact investing industry. The EDFI harmonisation initiative represents a concrete step towards a common approach to measuring impact, and comes one month after 12 European DFIs became first-adopters of the global Operating Principles for Impact Management.

The initiative will facilitate the development of common, non-financial accounting standards by which investors and enterprises will report on development impact achieved. Once in place, the European DFI’s will be able to attribute depth, transparency and meaning to the economic, environmental and social impact of their investments, and to understand the progress they’re making as a group.

Impact investment enhances risk, return and impact to the benefit people and the planet they inhabit. It does so by setting social and environmental objectives alongside financial ones. Governments across Europe government rely of their DFIs to be role models for private impact investment into the countries and sectors in greatest need of support to reach the SDGs and Paris Climate Agreement. This initiative will ensure that EDFI members remain re front-runners in this industry.

Nick O’Donohoe, CEO, CDC Group, said:

“As the UK’s leading impact investor, I’m delighted CDC will play a central role in the creation of credible and measurable metrics. These are essential to evaluating and showcasing the progress of our impact as we all work towards the Global Goals.”

“The European DFIs have long been at the forefront of responsible financing for sustainable development. We now build on our long experience as impact investors with strong commons commitments on effective measurement of impacts towards the SDGs,” explained Bruno Wenn, Chairman of EDFI.

“This EDFI initiative will work on an accelerated time line and we will share the first outcomes and lessons learned with the impact investment community already at the WB/IMF Annual Meetings later in 2019,” concluded Søren Peter Andreasen, CEO of EDFI.

To find out more about the initiative take a look at the links below:

EDFI Principles for Responsible Financing of Sustainable Development

EDFI Resolution on Gender Smart Investing

Operating Principles for Impact Management