– US$17.5m equity investment into southern Indian healthcare

– Capital to support expansion of business and creation of new hospitals

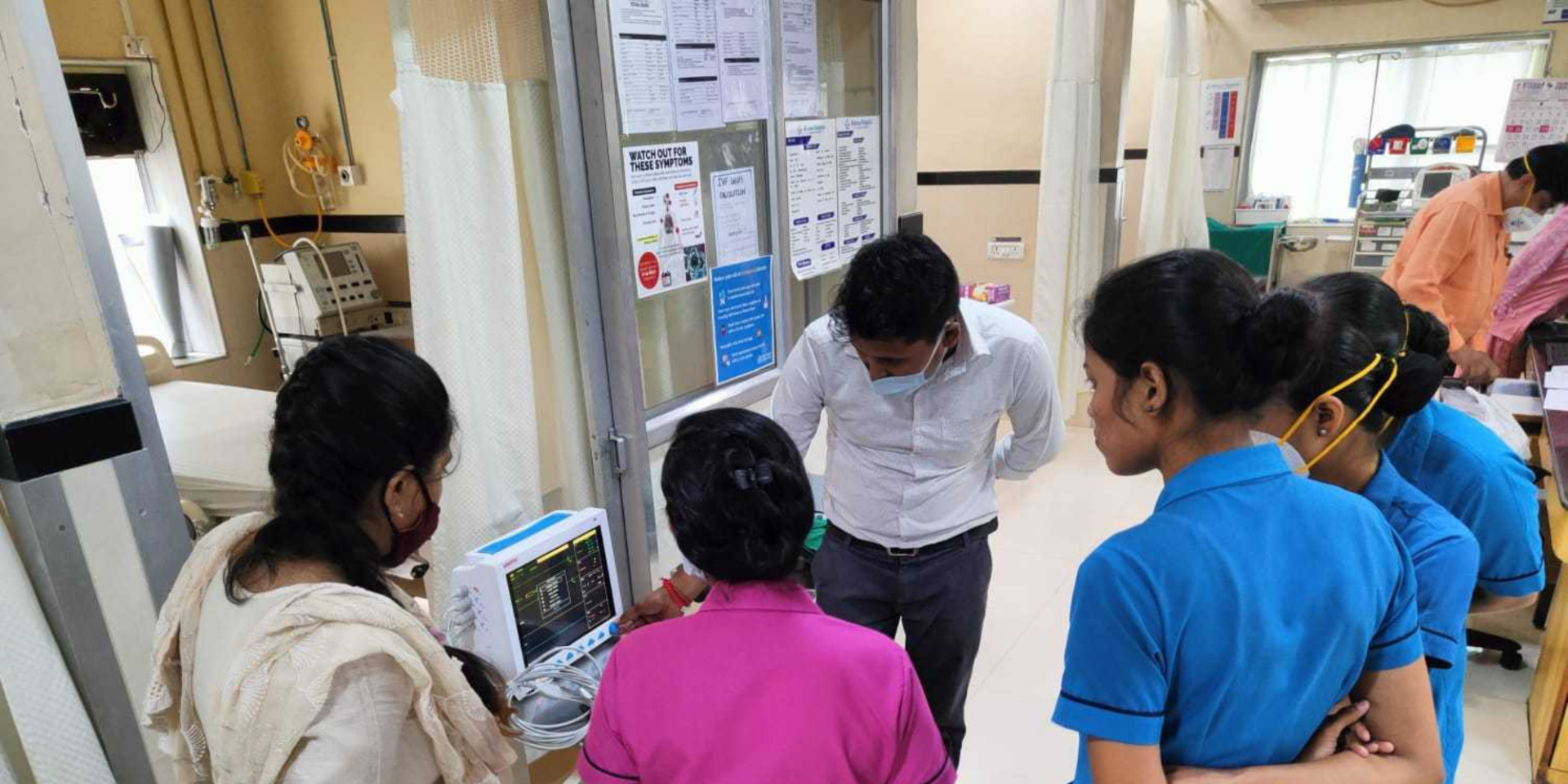

CDC, the UK’s development finance institution and The Abraaj Group (Abraaj), a leading investor operating in global growth markets, today announced their investment in Rainbow Hospitals, a 450-bed paediatric and maternity healthcare business based in the southern Indian state of Andhra Pradesh.

This is CDC’s first direct equity investment in India since the launch of its new strategy in late 2012. The investment also builds upon Abraaj’s long-standing partnerships with healthcare institutions in South Asia and represents its sixth healthcare investment in the region.

Established in 1999, Rainbow Hospitals is India’s largest specialized paediatric and maternity care company with four maternity, paediatric and neonatal intensive care units, and one outpatient clinic in Hyderabad. The business has expanded with four centres added in the last six years and intends to develop beyond the state of Andhra Pradesh, with new hospitals planned for cities such as Bangalore, Chennai and Pune, and tier two cities like Vizag and Kurnool.

Rainbow currently has its two largest hospitals certified with the Indian quality seal of the National Accreditation Board of Hospitals (NABH). The NABH demands high standards for hospitals, for example with regard to medical care and patient care as well as corporate governance. Rainbow also won “Best Children’s Hospital” by CNBC and ICICI Lombard in 2010 and made the top-5 children’s hospitals in India from “The Week” Hansa survey in 2010, 2011 & 2012. Rainbow’s Promoter and Founder is Dr Ramesh Kancharla who worked at King’s College Hospital and Great Ormond Street Children’s Hospital in London before returning to Hyderabad to establish Rainbow hospitals.

Welcoming the investment, Dr Ramesh Kancharla, Chairman and Managing Director, Rainbow Hospitals, said:

“This investment lets us expand and develop our high-quality medical facilities, allowing us to replicate the successful pioneering model across the country, including in cities such as Bangalore, Chennai and Pune. In parallel, we would also like to develop tertiary paediatric care in tier two cities like Vizag and Kurnool. The current investment would give us the capacity to expand the number of beds available to patients from the current level of 450+ to close to 1000 by 2017.”

Dr Kancharla added,

“The patient investment approach taken by CDC and Abraaj gives us the space to focus on the longer-term business quality and performance essential in multi-specialty paediatric care.”

Srini Nagarajan, CDC’s Regional Director for South Asia, said:

“This is an exciting first direct equity investment in India for CDC. Rainbow is a company with great financial and development potential. Its management team has already made it a leader in paediatric care in India and a centre for high-quality training and research and we will work closely with the company to give them the long-term capital and support they need to build the business.

“With employment in the group currently at around 1,000 people, we expect this to grow as much as four times over the course of our investment, led by the rapid growth in the Indian healthcare market. With demand expected to grow at around 15% per annum over the next decade, it’s clear that the gap in provision of healthcare in India will need to be plugged by the private sector.

“We’ll help the business develop its plan to become a national centre of excellence for the teaching of paediatric medicine and for helping other institutions to deliver quality care – with a focus on lower income groups. And we’ll also focus on building Rainbow’s value by strengthening its environmental, social and governance standards.”

Balaji Srinivas, Managing Director at The Abraaj Group, added,

“There is a pressing requirement in the Indian healthcare sector for paediatric healthcare infrastructure due to the demographics of the country, which witnesses high fertility, maternal and infant mortality rates. The private sector has a critical role to play in helping to reduce fatalities and improve healthcare facilities through targeted investments.

“The Abraaj Group has been an early and committed investor in the healthcare space and this transaction represents our 28th investment globally in this sector. We are confident that our investment and support, alongside CDC, will facilitate Rainbow’s ongoing growth to help it reach its goal of becoming the leader in women’s and paediatric care.”

Under its new strategy, announced in September 2012, CDC now provides direct debt and equity investment to businesses in South Asia and Africa as well as continuing to act as a fund-of-funds investor. From 2004 – 2010 CDC operated primarily as a fund-of-funds investor, investing in companies through intermediary fund managers.