- Enables lending to businesses in critical sub-sectors of the Nigerian economy

- Gives Stanbic IBTC Bank PLC access to long-term dollar funding

CDC Group, the UK’s development finance institution and impact investor, has today announced a US$75 million debt commitment to Stanbic IBTC Bank PLC (‘’Stanbic IBTC’’), a subsidiary of Stanbic IBTC Holdings PLC and member of the Standard Bank Group.

CDC’s long-term funding will enable Stanbic IBTC to continue lending to businesses in sub-sectors of the economy that are important for domestic consumption and exports including food, manufacturing, telecommunications and construction.

The funding comes at a critical time given the current economic disruption caused by the COVID-19 pandemic, resulting in cash flow and access to finance challenges for companies in Nigeria. The sub-sectors targeted by the facility all employ large numbers of local staff and support substantial SME supply chains. This funding will ensure businesses in critical sectors are able to access capital to protect their operations and employees amid the ongoing economic uncertainty.

The strategically important manufacturing, food and agriculture sub-sectors, which make up more than a third of Stanbic IBTC’s current portfolio and pipeline, will particularly benefit from this investment.

CDC’s debt commitment will also give Stanbic IBTC access to long-term dollar funding, which is difficult to raise in the commercial market even under normal conditions. Long-term dollar funding will enable Stanbic IBTC to lend to exporting and other dollar earning businesses in Nigeria, thus supporting key growth sectors of the economy.

This investment contributes to the UN Sustainable Development Goals 2 (Zero Hunger) and 8 (Decent Work and Economic Growth).

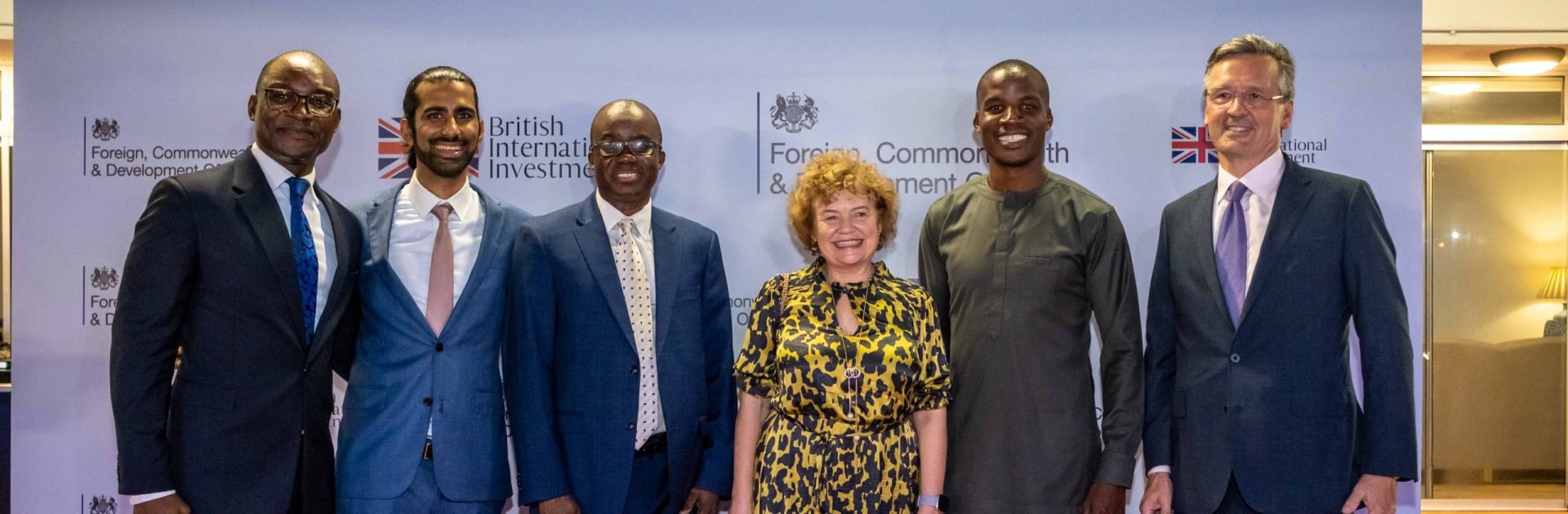

Benson Adenuga, Head of CDC Nigeria Office and Coverage Director said:

“This debt facility is an important step in supporting Nigerian businesses in crucial sub-sectors such as food and agriculture. This deal cements our relationships with Stanbic IBTC and Standard Bank Group, both key partners in Nigeria and across the continent. Our patient capital plays an important role in unlocking dollar funding, which is vital to finance longer-term investment projects in Nigeria.

We have been investing in Nigeria for over 70 years, currently we are partnering with nearly 100 companies here. We continue to prioritise Nigeria as a key investment region.”

Wole Adeniyi, Chief Executive, Stanbic IBTC Bank PLC: “Our partnership with CDC will strengthen Stanbic IBTC’s commitment to support Nigerian businesses amid the current context. Continuing to provide financing to local businesses is fundamental to mitigating the impacts of COVID-19 and accelerating Nigeria’s long-term economic recovery.”

ENDS

Media Contact:

CDC: Clare Murray M. +44 (0) 7887 993 356

About CDC

1. CDC Group is the UK’s first impact investor with over 70 years of experience of successfully supporting the sustainable, long-term growth of businesses in South Asia and Africa.

2. CDC is a leading player in the fight against climate change and a UK champion of the UN’s Sustainable Development Goals – the global blueprint to achieve a better and more sustainable future for us all.

3. The company has investments in over 1,200 businesses in emerging economies and a total portfolio value of £5.8bn. This year CDC will invest over $1.5bn in companies in Africa and Asia with a focus on fighting climate change, empowering women and creating new jobs and opportunities for millions of people.

4. CDC is funded by the UK government and all proceeds from its investments are reinvested to improve the lives of millions of people in Africa and South Asia.

5. CDC’s expertise makes it the perfect partner for private investors looking to devote capital to making a measurable environmental and social impact in countries most in need of investment.

About Stanbic IBTC

Stanbic IBTC Holdings PLC, a member of Standard Bank Group, is a full-service financial services group with a clear focus on three main business pillars – Corporate and Investment Banking, Personal and Business Banking and Wealth Management.

The Standard Bank’s largest shareholder is the Industrial and Commercial Bank of China (ICBC), the world’s largest bank, with a 20.1% shareholding. In addition, Standard Bank Group and ICBC share a strategic partnership that facilitates trade and deal flow between Africa, China and select emerging markets. Standard Bank Group is the largest African financial institution by assets.

It is rooted in Africa with strategic representation in 21 countries on the African continent. Standard Bank has been in operation for over 157 years and is focused on building first-class, on-the-ground financial services institutions in chosen countries in Africa; and connecting selected emerging markets to Africa by applying sector expertise, particularly in natural resources, power and infrastructure.