CDC has helped to fund a $162.5 million syndicated loan package to Nigeria’s Access Bank Plc. The bank is a systemically important financial institution in Nigeria that is increasingly supporting local micro, small, and medium-size enterprises. Our capital will help broaden this strategy, thereby supporting job creation in the Nigerian economy. Just last month, we anchored Nigeria’s CardinalStone Capital Advisors Growth Fund (“CCA”), a first-time fund that also targets SMEs across multiple sectors.

The $162.5 million syndicated loan facility was led by FMO and includes other DFIs and impact investors such as DEG, BIO (Belgian Investment Company for Developing Countries), Finnfund, Norfund and Blue Orchard Microfinance Fund. The Tier II facility enables Access Bank to raise long-term capital, which is difficult to attract in the commercial market amid the country’s recent recession and ongoing elections.

Despite having the largest economy in Africa and the second largest banking sector on the Continent after South Africa, banking penetration remains disproportionately low in Nigeria. Credit penetration in Nigeria is under 15%, substantially lower than other countries in sub-Saharan Africa. Access Bank Nigeria is in a strong position to help change this, it has total assets of US $15 billion, ranking it the third largest bank in Nigeria. It also has a presence in six other African countries.

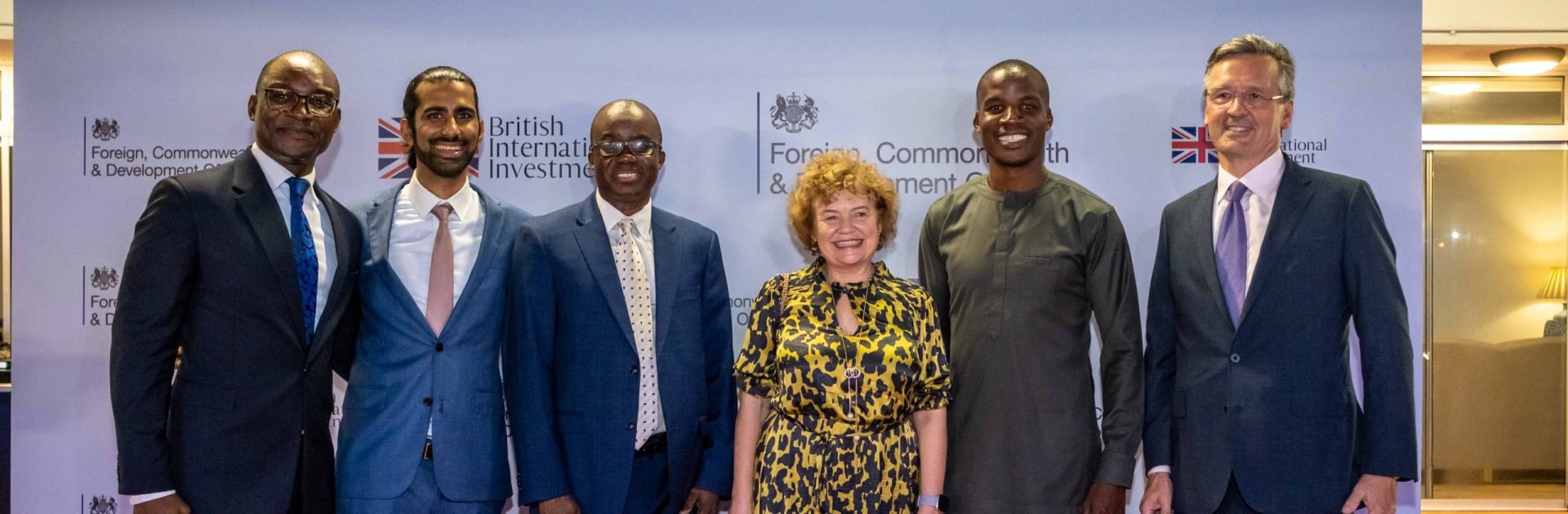

We recently announced our ambition to invest up to US$4.5bn across Africa over the next three years. In November 2018 a CDC delegation led by Chief Executive Nick O’Donohoe and Chairman Graham Wrigley met Nigerian investors, regulators and politicians to discuss CDC’s continued motivation to partner with Nigeria, and to explore ways to encourage more domestic and foreign investment in the country.