CDC backs innovative Indian healthcare provider with US$48m investment

– Narayana Health to expand affordable treatment in Eastern, Central and Western India –

CDC Group, the UK’s development finance institution, has today announced a US$48 million investment in Narayana Hrudayalaya Hospitals (“NH”), a multi-specialty healthcare provider founded by the renowned cardiac surgeon Dr Devi Shetty.

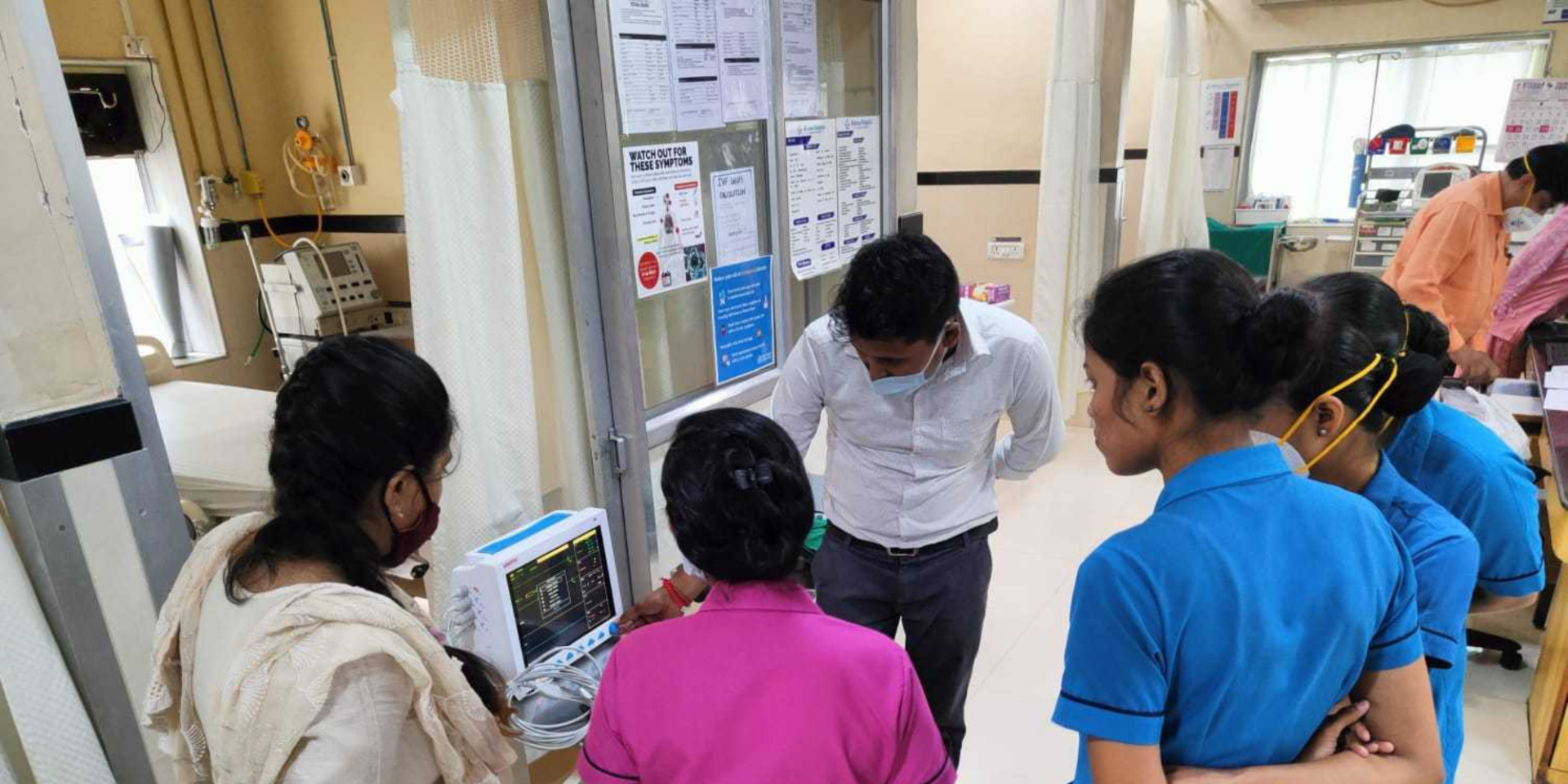

NH operates a chain of hospitals across India, under the brand name Narayana Health, providing affordable, high-quality health care, with a particular focus on cardiac, cancer and other super-speciality tertiary care treatment. CDC will receive a small minority stake in return for its investment.

NH was founded in 2000 by Dr Shetty and has grown to become India’s third-largest hospital chain, with 29 hospitals in 17 Indian cities. Starting out as a cardiac care provider in Bangalore, NH is one of India’s fastest growing healthcare groups and is known for its innovative model of large-scale, affordable and high-quality service. CDC’s capital will help the company build or expand hospitals in cities such as Kolkata, Lucknow, Bhubaneshwar and Bangalore.

Employing over 12,500 people, NH now undertakes more than 13,500 cardiac surgeries every year, accounting for 10% of the national figure. The company treats over 200,000 inpatients and 1.5 million outpatients each year.

Srini Nagarajan, CDC’s Head of South Asia said:

Narayana Health has set itself an ambitious growth plan, building on the 60% increase in beds it has delivered in the last 2 years. The healthcare provider expects to create at least an additional 8,000 jobs.

Dr. Devi Shetty, NH’s Founder and Chairman said:

The company also operates one of the world’s largest telemedicine networks with 150 telemedicine centres including 50 in Africa. This system allows remote health facilities outside of main hospitals to seek advice from consultants at Narayana Health free-of-charge. NH has formally signed up to the UK’s Department for International Development-supported SHE initiative (Safety, Health, Education & Employment for Girls and Women) to deliver vocational training in Healthcare to unemployed youths from rural India in association with Healthcare Sector Skilled council (NSDC).

CDC has been an investor in India since 1987, focusing on supporting the country’s nascent private equity industry in the 2000s as a fund-of-funds investor. In 2012, CDC started to provide direct equity and debt to companies in poorer parts of Africa and South Asia.

CDC recently made a US$11 million equity investment in the Indian microfinance institution, Utkarsh. Based in Uttar Pradesh, the company provides financial services to the under-served and unbanked low-income rural population in the north east of India. CDC has made a number of other direct investments in India in 2014 as part of a nationwide strategy to support growing businesses that create jobs and opportunities. These include Ratnakar Bank and the microfinance company, Equitas.

CDC also continues to invest in the Indian private equity industry and made a new US$30 million commitment Rabo Equity’s India Agri Business Fund 2, a pioneering investment fund focused on India’s food and agribusiness sector.