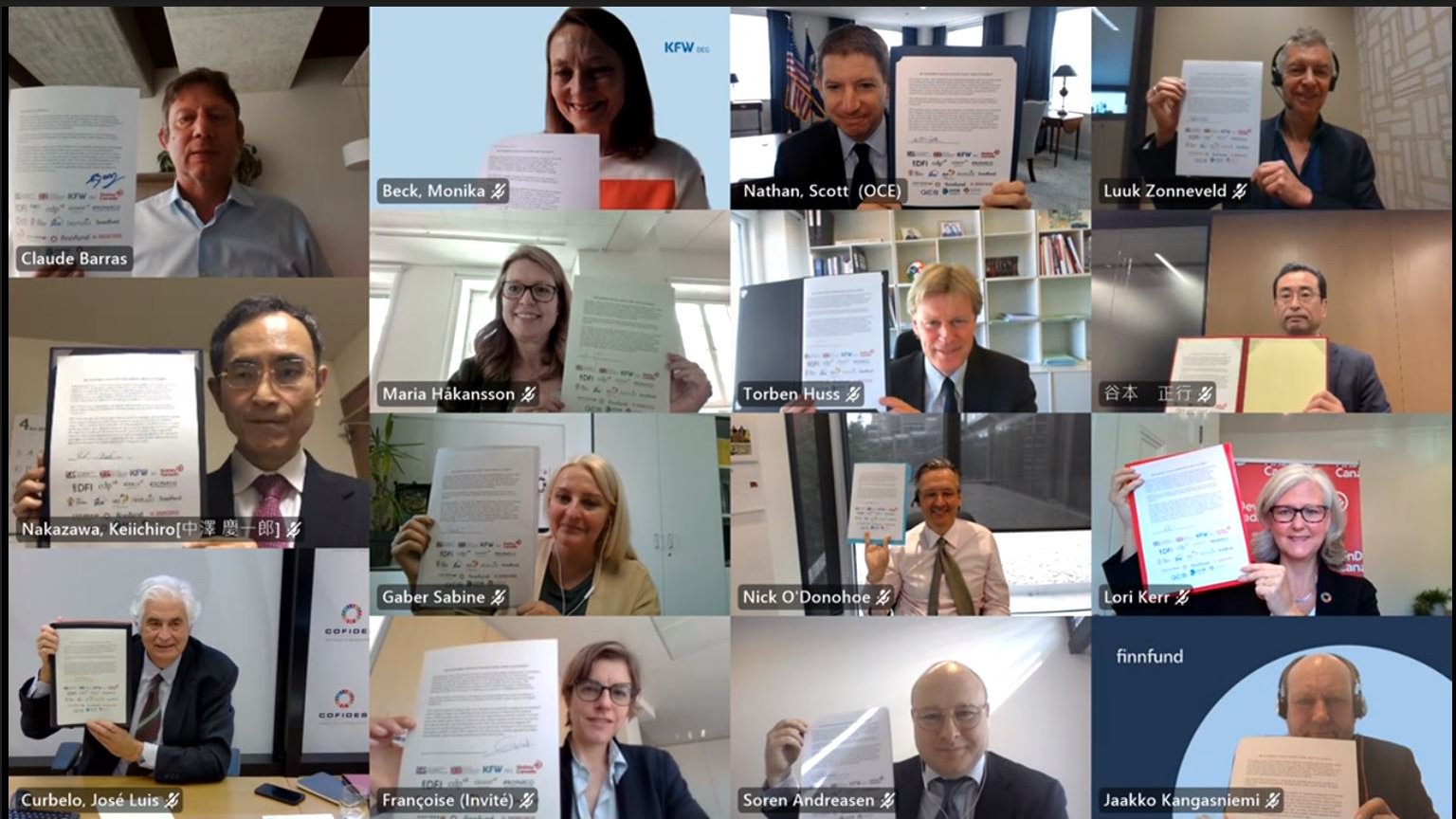

The Development Finance Institutions (DFIs) of 16 OECD countries, grouped under the DFI Alliance, issued a joint statement to announce they will work together to respond to the COVID-19 global pandemic in developing countries. The group will work collaboratively to bring liquidity to the market, support companies impacted by the virus, and promote new investment in global health, safety, and economic sustainability.

Read the full statement below:

“The Development Finance Institutions (DFIs) of 16 OECD countries, grouped under the DFI Alliance, are committed to working collaboratively to meet the unprecedented global demands resulting from the outbreak of COVID-19. This unparalleled health crisis will seriously impact developing countries in ways that will impede their economic and social progress.

The ability of DFIs to mobilize significant financial resources and bring technical expertise to private sector enterprises in emerging and frontier markets will be more important than ever. The DFI Alliance members, through enhanced cooperation and the leveraging of pooled resources, will focus on reducing the impact of COVID-19 on essential business activities in these countries.

Together, DFIs are working around the world to help resolve current liquidity issues in financial sectors, support the viability of existing companies impacted by the virus, and promote new investment in goods and services necessary to global health, safety, and economic sustainability. The DFI Alliance is developing mechanisms designed to sustain companies, return them to full production, and restore employment opportunities essential to the societies in which they operate.

In addition, the DFI Alliance is identifying opportunities to finance the local private sector response to the health crisis with the goal of speeding recovery. These DFIs commit to working together to identify where needs in the private sector are greatest and to find solutions that will reduce the impact of COVID-19 around the world.”

About the DFI Alliance

U.S. International Development Finance Corporation (DFC), FinDev Canada, and the Association of European Development Finance Institutions (EDFI*), currently counting 15 “bilateral” member institutions within the field of development finance for the private sector in emerging and frontier markets, formed the “DFI Alliance” in 2019 as a framework for their active cooperative engagement. These DFIs all hold high standards for corporate governance, sustainability and impact management, and seek to act as role models for other investors.

About EDFI, the Association of European Development Finance Institutions

EDFI promotes the work of 15 bilateral European development finance institutions that invest in the private sector in emerging and frontier markets to create jobs, boost growth, and fight poverty and climate change. Since EDFI was set up in 1992, its members have invested in app. 15,000 projects, and they now manage a combined investment portfolio of US$50 billion across financial services, clean energy, industry and many other sectors in more than 100 countries. A significant share of this portfolio is climate finance. An important part of EDFI’s work is to promote financial cooperation between its members and with the EU institutions, and for this purpose EDFI has established the EDFI Management Company and other joint financing facilities.

For more information, visit www.edfi.eu

* EDFI member institutions: BIO (Belgium), BMI/SBI (Belgium), CDC (United Kingdom), Cofides (Spain), KfW-DEG (Germany), Finnfund (Finland), FMO (The Netherlands), IFU (Denmark), Norfund (Norway), Austrian Development Bank OeEB (Austria), PROPARCO (France), Sifem (Switzerland), Simest and CDP International Development Finance (Italy), Sofid (Portugal), and Swedfund (Sweden).

About CDC:

CDC Group is the UK’s first impact investor with over 70 years of experience of successfully supporting the sustainable, long-term growth of businesses in South Asia and Africa.

CDC is a leading player in the fight against climate change and a UK champion of the UN’s Sustainable Development Goals – the global blueprint to achieve a better and more sustainable future for us all.

The company has investments in over 1,200 businesses in emerging economies and a total portfolio value of £5.8bn. This year CDC will invest over $1.5bn in companies in Africa and Asia with a focus on fighting climate change, empowering women and creating new jobs and opportunities for millions of people.

CDC is funded by the UK government and all proceeds from its investments are reinvested to improve the lives of millions of people in Africa and South Asia.

CDC’s expertise makes it the perfect partner for private investors looking to devote capital to making a measurable environmental and social impact in countries most in need of investment.

About DFC

U.S. International Development Finance Corporation (DFC) is America’s development bank. DFC partners with the private sector to finance solutions to the most critical challenges facing the developing world today. We invest across sectors including energy, healthcare, critical infrastructure, and technology. DFC also provides financing for small businesses and women entrepreneurs in order to create jobs in emerging markets. DFC investments adhere to high standards and respect the environment, human rights, and worker rights.

About FinDev Canada

The Development Finance Institute Canada Inc., operating under the FinDev Canada brand, is a Canadian institution dedicated to providing financial services to the private sector in developing countries with the aim of combating poverty through economic growth by focusing on three main themes: economic development through job creation, women economic empowerment, and climate change mitigation. The Development Finance Institute Canada Inc. is a wholly owned subsidiary of Export Development Canada (EDC). Find out more about FinDev Canada here.