-

EDFI group outlines shared commitments to phase out fossil fuels and mobilise private sector climate finance, aligning with Paris Agreement and high disclosure standards.

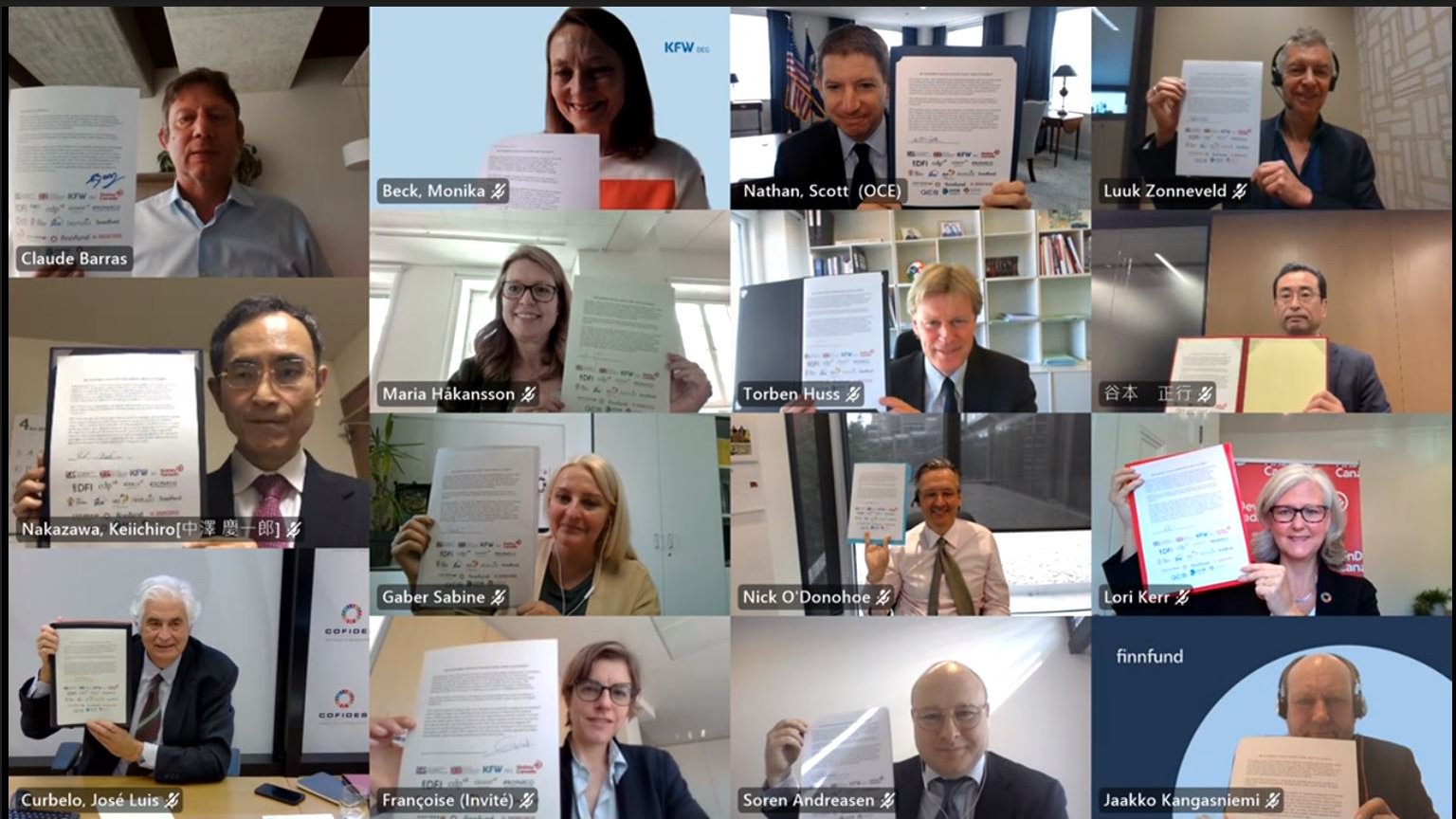

The Association of European Development Finance Institutions (EDFI), which has a combined $50 billion under management in emerging and frontier markets, today announced that its 15 members will phase out fossil fuel investments by 2030.

The group of publicly-owned institutions said it will align all new financing decisions with the objectives of the Paris Agreement by 2022 and will ensure that their portfolios achieve net zero emissions by 2050 at the latest.

The EDFI group will immediately cease new coal or fuel oil financing and will limit other fossil fuels, such as selective investments in gas-fired power generation, to financing consistent with the objectives of the Paris Agreement until generally excluding them by 2030 at the latest. The new commitment includes direct investments, indirect investments made through other funds and dedicated lending via financial institutions.

In its statement today, EDFI said: “A significant and progressive alignment of private capital flows to developing countries will be required to reach the UN Sustainable Development Goals by 2030 and to implement the Paris Agreement. Over the past five years, the European DFIs have committed €8 billion to climate finance in low and middle-income countries. Now, in the lead-up to COP 26, and as countries around the world strive to achieve a sustainable recovery from the Covid-19 pandemic, it is more important than ever that European DFIs set a collective example for investors in developing markets.”

The fossil fuel sub-sectors that will be immediately excluded include:

- Coal prospection, exploration, mining or processing

- Oil exploration or production

- Standalone fossil gas exploration and/or production

- Transport and related infrastructure primarily used for coal for power generation

- Crude oil pipelines

- Oil refineries

- Construction of new or refurbishment of any existing coal-fired power plant (including dual)

- Construction of new or refurbishment of any existing HFO-only or diesel-only power plant

- Producing energy for the public grid and leading to an increase of absolute GHG emissions

- Any business with planned expansion of captive coal used for power and/or heat generation

The institutions are determined to build on their strong track-record in climate finance and mobilise private sector climate finance by holding themselves to ambitious individual targets and reporting on their progress.

Søren Peter Andreasen, CEO of EDFI, said: “As taxpayer funded organisations, we are committed to promoting green growth, climate adaptation and resilience, nature-based solutions, access to green energy and a just transition to a low-carbon economy. Today’s announcement underlines that commitment.

“DFIs are diverse institutions that will follow different paths in and use their best efforts to implement these commitments, with some institutions going even further in certain areas and others needing more time for implementation. By working together on these joint ambitions, European DFIs will take full account of their effects on the planet without compromising on their development impact.”

Nick O’Donohoe, Chief Executive of CDC Group, the UK’s DFI and impact investor, said:

“I am delighted that all the 15 European DFIs, including CDC, are working together to invest in a sustainable economic future for some of the least developed nations in the world. International cooperation to mobilise private finance is vital to support countries pathways to net zero emissions and to accelerate investment in the climate adaptation solutions that are urgently needed.”

The EDFI group’s institutions will also make climate related financial disclosures in line with the recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”).

For the full EDFI statement and technical specifications, please see here

ENDS

About EDFI – the Association of European Development Finance Institutions

EDFI promotes the work of 15 bilateral European development finance institutions that invest in the private sector in emerging and frontier markets to create jobs, boost growth, and fight poverty and climate change. Since EDFI was set up in 1992, its members have invested in app. 15,000 projects, and they now manage a combined investment portfolio of EUR 46 billion across financial services, clean energy, industry and many other sectors in more than 100 countries. EDFI’s member institutions include BIO (Belgium), BMI-SBI (Belgium). CDC Group (UK). COFIDES (Spain), KfW-DEG (Germany), Finnfund (Finland), FMO (Netherlands), IFU (Denmark), Norfund (Norway), OeEB (Austria), Proparco (France), SIFEM (Switzerland), Simest (Italy), SOFID (Portugal), and Swedfund (Sweden).

Learn more at www.edfi.eu

Press contacts:

- Andrew Murray-Watson, CDC Group: amurray-watson@bii.co.uk

- James Brenton, EDFI: James.brenton@edfi.eu

- Mathilde Poncelet, EDFI: Mathilde.poncelet@edfi.eu | m: +32 471 850 610