CDC, the UK’s development finance institution, has today announced a new investment designed to support high-growth SMEs in Nigeria. CDC has made a US$15 million commitment to CardinalStone Capital Advisors Growth Fund (“CCA”).

CCA is a first-time, Nigeria-focused fund that targets SMEs across six sectors: agriculture, industrials, FMCG, healthcare, education and financial services. CCA will use CDC’s capital to invest in companies which support job creation, as well as import substitution to diversify the Nigerian economy.

CDC has worked closely with the CardinalStone Capital Advisors team for two and a half years and played a key role in the formation of the fund. CDC is an anchor investor alongside Kuramo, a leading African investment firm, and has helped mobilise additional investment of US$15 million from the Dutch development bank FMO and NSIA (the Nigerian sovereign wealth fund). The fund has reached US$50 million of commitments at first close.

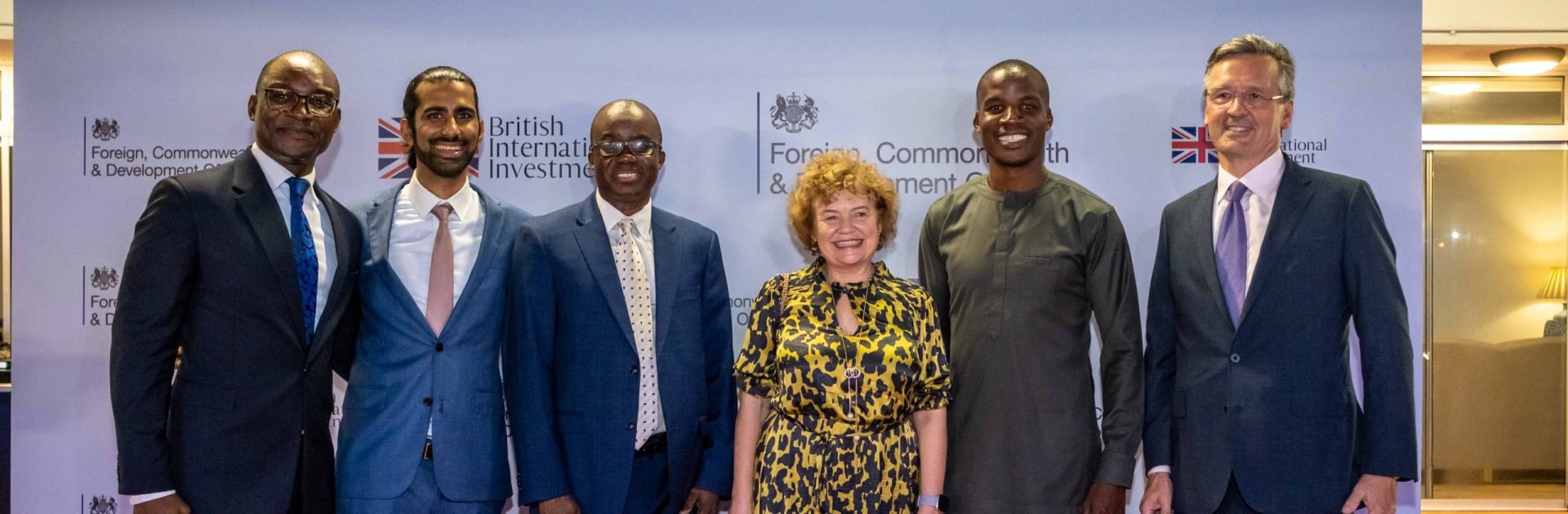

Clarisa de Franco, CDC’s Managing Director said:

“As a pioneering investor in African private equity we are delighted to be supporting CardinalStone’s first fund that will bring investment and expertise to the local entrepreneurs and high growth SMEs that are vital to Nigeria’s long-term economic growth and job creation. We have worked with CardinalStone from the beginning, helping them build a team and raise other investment.

“CDC has invested in Nigeria for 70 years. The country plays a key part in CDC’s strategy of partnership and investment for economic growth in West Africa.”

CDC recently announced its ambition to invest up to US$4.5bn across Africa over the next four years. In November 2018 a CDC delegation led by Chief Executive Nick O’Donohoe and Chairman Graham Wrigley met Nigerian investors, regulators and politicians to discuss CDC’s continued ambition to partner with Nigeria, and to explore ways to encourage more domestic and foreign investment in the country.

CDC has played a pioneering role in supporting the private equity industry in Nigeria which channels growth capital to companies. Twenty years ago, CDC backed Nigeria’s first private equity fund, the Capital Alliance Private Equity Fund I from African Capital Alliance and has invested in all five of its subsequent funds. African Capital Alliance remains a market-leading investor in Nigeria. In November 2018, CDC also announced a US$25 million investment in Nigerian-led, Synergy Private Equity Fund II which invests in high-growth SME businesses in Nigeria and its West African neighbours.

Media Contact:

Rhyddid Carter +44 (0)20 7963 4741 or +44 (0)7824 552 326 (rcarter@bii.co.uk)