CDC Group plc, the UK’s development finance institution, has today announced a commitment of US$25 million to a local fund backing small and medium-sized businesses in Nigeria. In addition, CDC will open a regional office for West Africa in Lagos in early 2019.

CDC has been active in Nigeria for 70 years and currently has almost US$400 million invested in the country. Its portfolio of 82 businesses support 41,000 direct jobs. Recent CDC investments in Nigeria include Afreximbank, Jumia, Indorama and Azura Power. CDC is part of a growing UK Government ‘Prosperity’ offer to support Nigerian growth and poverty reduction, working alongside UK Aid’s development, trade and economic teams.

CDC committed US$25 million to the Nigerian-led, Synergy Private Equity Fund II (“Synergy II”) which invests in high-growth SME businesses in Nigeria and its West African neighbours. Supporting SMEs is central to CDC’s mission to help build sustainable businesses, create jobs and improve economic prosperity. Our new investment enabled Synergy II to raise a total of US$232 million of capital; the Fund is targeting a total of US$300 million. CDC is also an investor in Synergy’s first fund.

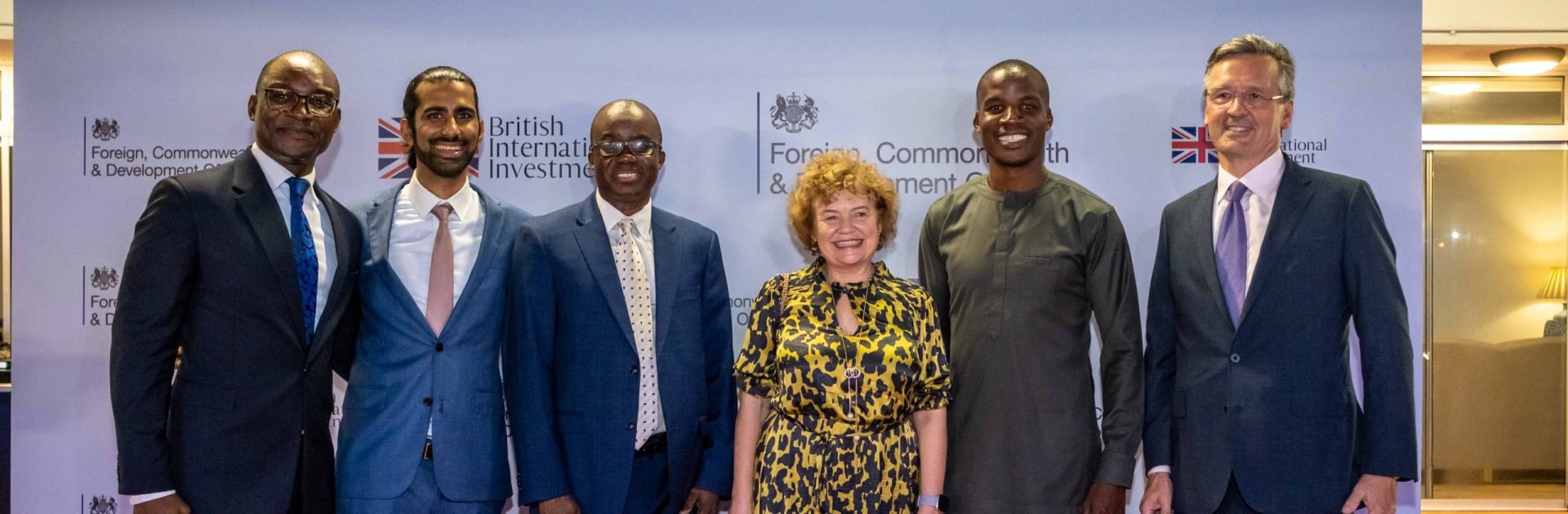

This week sees a CDC delegation in Lagos again following a recent trip alongside Prime Minister Rt. Hon Theresa May MP in August. It will be led by CDC Chief Executive Nick O’Donohoe and Chairman Graham Wrigley who will meet Nigerian investors, regulators and politicians at a roundtable. Key to discussions is CDC’s continued ambition to partner with Nigeria and explore ways of further collaboration. CDC aims to invest in Nigeria’s capital markets and encourage more domestic and foreign investment. CDC also marks its 70th anniversary with an event at the Deputy British High Commission in Lagos.

CDC’s Chief Executive, Nick O’Donohoe commented:

“Nigeria plays a key part in our strategy of partnership and investment for economic growth in West Africa. CDC’s support for Synergy Fund II will help to boost Nigeria’s high-growth SMEs, supporting local entrepreneurs, job creation and economic development. We recently announced our ambition to invest up to US$4.5bn across Africa over the next four years. This latest US$25 million commitment and new office launch builds on our recent momentum in Nigeria and demonstrates our commitment.”

CDC has played a pioneering role in supporting the private equity industry in Nigeria which channels growth capital to companies. Twenty years ago, CDC backed Nigeria’s first private equity fund, the Capital Alliance Private Equity Fund I (CAPE I) from African Capital Alliance and has invested in all five of its subsequent funds. African Capital Alliance remains a market-leading investor in Nigeria.

CDC is part of a growing UK Government ‘Prosperity’ offer to support Nigerian growth and poverty reduction, working alongside UKAid’s development, trade and economic teams.

Media Contacts:

Rhyddid Carter +44 (0)20 7963 4741 or +44 (0)7824 552 326

Clare Murray +44 (0)7887 993356