Shell Foundation (SF), the UK-registered charity supporting energy access market solutions in Africa and South Asia, recently signed a memorandum of understanding (MoU) with British International Investment (BII), the UK’s development finance institution and impact investor, to work in partnership to support the just and inclusive energy transition in sub-Saharan Africa and South Asia.

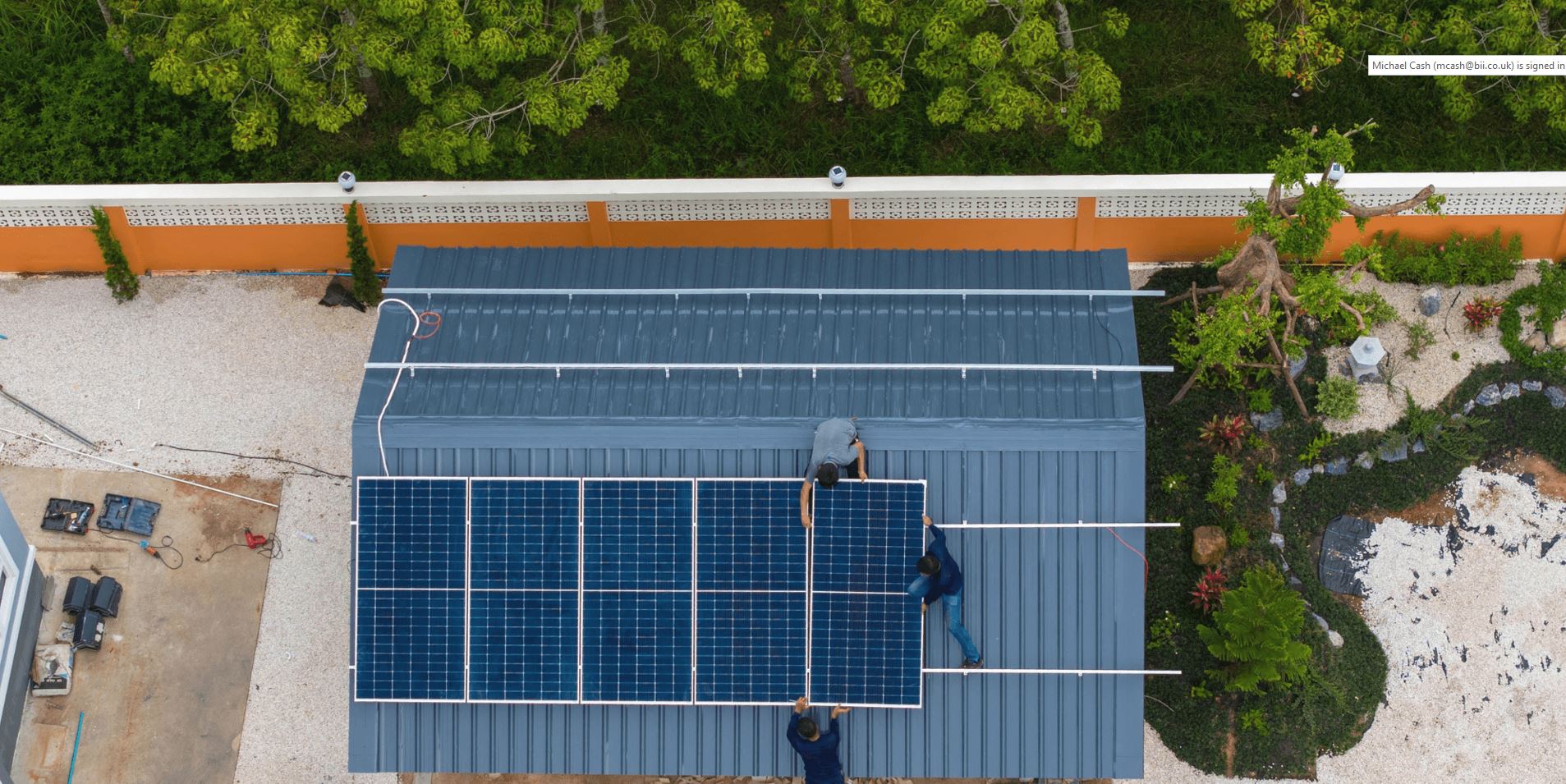

Through the MoU, the institutions will provide investment to help address the finance barriers that exist for early to mid-stage businesses in sectors aligned with BII’s strategic priorities and SF’s charitable objectives including, but not limited to, distributed renewable energy, e-mobility and agri-tech, as well as supporting cross-cutting solutions in the areas of climate and gender inclusion.

It is estimated that 773 million people globally lack access to electricity, mostly in sub-Saharan Africa and Asia. Achieving Africa’s energy and climate goals will require more than US$190 billion each year from 2026 to 2030, with two-thirds going to clean energy. For South Asia to achieve its renewable energy potential, over US$410 billion is required by 2030.

Unlocking more finance is critical to achieving these energy goals. Under this partnership, BII and SF will endeavour to make up to $245m financing available by 2026 to private sector projects that support investment into high-impact sustainable and clean energy solutions in sub-Saharan Africa and South Asia.

“In the coming decade, millions of people in emerging markets could earn a living income for the first time using clean energy,” said Jonathan Berman, CEO of Shell Foundation. “Partnering with BII is a great opportunity for us to enable that by providing capital at different risk appetites and stages of growth. We are aligned in vision, in values and most of all, in our recognition of the necessity to scale with urgency the solutions with which people can transform their lives.”

Yasemin Saltuk Lamy, MD and Head of Asset Allocation and Capital Solutions at BII added: “This partnership furthers our objective to support emerging economies to transition to and scale up clean and reliable energy that is inclusive, will create new job opportunities, support resilient economic growth as well as help to close the finance and energy access gaps.”

The MoU complements SF’s long-term co-funding partnership with FCDO (the sole shareholder of BII), which provides early-stage and high-risk grant funding through the Transforming Energy Access (TEA) platform, and the Catalysing Agriculture by Scaling Energy Ecosystems (CASEE) programme. Both TEA and CASEE have existing track record of supporting high-impact businesses and initiatives to reach scale and achieve greater impact. Such investments include:

- Equator, a climate-tech venture capital firm focused on Sub-Saharan Africa, recently announced the initial close of its first fund with approximately US$40 million in commitments, including from BII, SF and FCDO, to support seed and series A-stage, tech-enabled ventures in the sectors of energy, agriculture and mobility through a critical phase in their funding journey.

- Pula, an agricultural insurance and technology company that designs and delivers innovative agricultural insurance and digital products to help smallholder farmers in Africa. SF has supported Pula since 2020 as part of the CASEE portfolio, whilst BII is invested in Pula through TLCom TIDE Africa Fund, which is managed by Tide Africa GP LP and has backed some of Africa’s most prominent early-stage companies.

ENDS

For more information contact: press@bii.co.uk