BlueOrchard

Responding to a crisis: Keeping small businesses alive

When facing a crisis, you need to be able to act swiftly and work with those you know and trust.

From our experience during the Ebola crisis, we know that access to finance during such times is critical to sustaining businesses and communities, which in turn protect jobs and livelihoods.

When COVID-19 first hit emerging economies, development finance institutions needed to find the most effective method of quickly getting capital to where it was needed and could have the greatest impact.

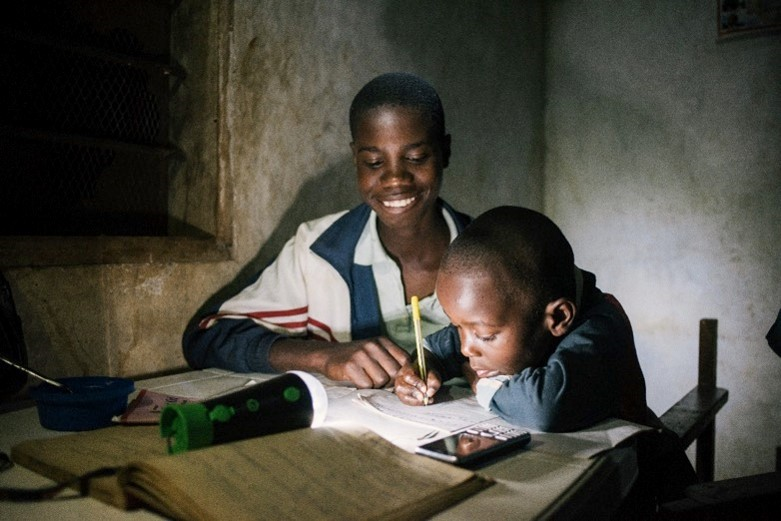

Providing capital to financial institutions where it is most needed, is a proven method for reaching more vulnerable market segments, such as women, who struggle to access finance even during periods of relative economic calm.

Under crisis circumstances, the challenges of accessing finance are significant. During the COVID pandemic, when countries went into lockdown, businesses faced a dual problem; first supply chains were disrupted and second, they couldn’t sell to consumers. Added to that, because of the crisis, capital providers such as banks and investors became nervous and withdrew to markets they perceived to be safer.

So the impact on businesses was compounded – not only were they unable to bring in revenue, but at the same time they couldn’t access the credit they so desperately needed either.

Partnering with BlueOrchard, a pioneering impact investor, DFIs, including CDC, JICA , KfW and FSDA, committed to a new fund, focused on reaching MSMEs (micro, small and medium enterprises). The group was joined also by US DFC, the Visa Foundation and IDBI.

Our team worked together with BlueOrchard to ensure the fund would reach low income and vulnerable populations across our markets and provide necessary value-add to enhance the impact of the capital through an integrated technical assistance facility provided by the Swiss State Secretariat for Economic Affairs.

The fund is already having significant impact. As of June 2021, it has invested in 25 financial institutions across 17 countries, including in Africa and South Asia.

It is supporting 10 million jobs and mitigating the impact of the pandemic on disrupted supply chains. Over a quarter of the loans are supporting trade, with a fifth going to consumer facing businesses and over a tenth to industry and agriculture.

Our investment is focused on a sub-fund (the ‘AfrAsia Sub-fund’), which has 64 per cent portfolio exposure in Africa and 36 per cent in South Asia. Over a quarter of the loans are supporting trade, with a fifth going to consumer-facing businesses and over a tenth to industry and agriculture.

What’s more, it is reaching the intended customers. In June 2021, over 70 per cent of loans made by the fund’s portfolio institutions went to female entrepreneurs. And the average loan size supported by the Africa and South Asia part of the fund was approximately $4,263.

One example of the kind of customer being supported by the fund is Mr Mahinder, a small business owner who is the only earner in his family. Prior to the pandemic, his shop in Haryana, India, generated enough income to comfortably support him, his wife, and their two children. The shop sells essential goods and groceries which he normally buys with a mixture of credit and his savings.

However, when COVID-19 struck, the regional lockdown meant he was unable to access additional credit and had to rely on existing stock and his savings at a time when he was only receiving a fraction of his regular income.

In need of capital to manage his debt as well as restock his shop, Mr Mahinder contacted AVIOM, a social impact-focused housing finance company backed by the BlueOrchard fund. In July 2020 AVIOM approved a loan that paid off his debts and enabled him to restock his shop. He is now able to support his family and keep his shop open for customers.

The fund is also meeting its target of supporting women, crucial given the disproportionate impact that the pandemic has had on women and girls.

Last year it qualified as a 2X investment – an initiative set up by the development finance institutions of the G7 to mobilise capital towards women’s economic empowerment in emerging markets. By June 2021, over 70 per cent of loans backed by the fund had gone to female entrepreneurs.

No one doubts that in emerging economies, the recovery from COVID is far from over. The World Bank estimated that growth in emerging and low-income economies will underperform the global average until at least 2022. Keeping capital flowing to businesses in these countries will remain vital to maintain and encourage economic activity. BlueOrchard’s fund will continue to support those businesses that most need capital to protect jobs and livelihoods.