How best to finance off-grid solar companies

How we're thinking about financing off-grid solar

We recently launched a new report alongside our colleagues at CGAP that looks at how best to finance off-grid solar companies that use pay-as-you-go (PAYGo) technology to deliver modern, green energy to millions of Africans.

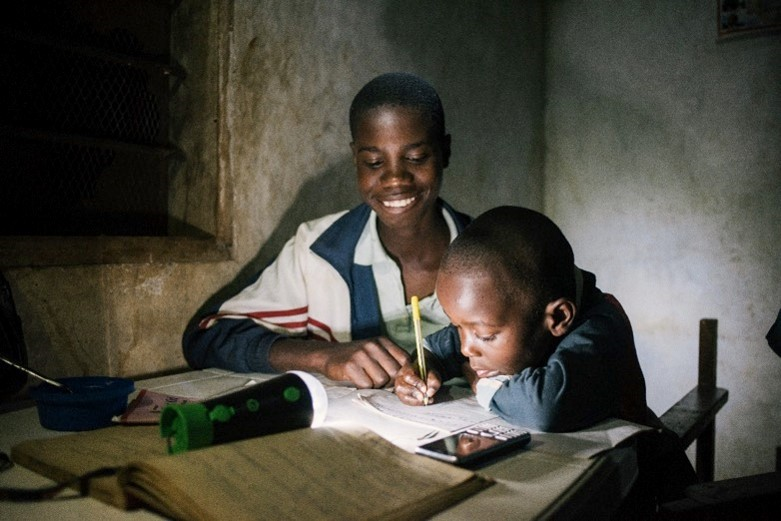

600 million Africans – 70 per cent of the population – currently live without access to electricity. Many live in rural or peri-urban areas and are unlikely to be connected to the electricity grid in the near future. Off-grid solar companies can help address this challenge. By selling Solar Home Systems and related appliances and allowing customers to pay for the system over time, PAYGo solar companies make these systems affordable and bring the benefits of clean, reliable energy to those without electricity.

Under the PAYGo model, a customer makes flexible daily, weekly or monthly payments through mobile money to progressively acquire their Solar Home System. If a customer is late in making a payment, their system shuts off automatically, and they can reactivate it by making a new payment. Once the customer has finished paying for the system, it unlocks permanently and becomes his or her property.

Over 2.5 million households now have access to solar power thanks to PAYGo companies, but the sector needs more capital to grow. PAYGo companies pay their suppliers for solar systems up front but must wait 12 to 36 months to collect the full cash payment of the systems from their customers. This time difference between payment and cash collection creates large and growing financing needs that companies usually address by raising loans from investors. As with any bank or micro-finance lender, the ability of the PAYGo company to collect repayments from their customers, known as loan servicing, is critical to its long-term financial viability. By extension, lenders to PAYGo companies also bear this fundamental risk.

A new report from CDC and CGAP

Our new report, published alongside financial inclusion specialists CGAP, “Taming the Strange Beasts: Servicing and the Future of PAYGo” is co-authored by CDC’s Geoff Manley, Emma Hawkins and Mathilde Girard, and looks at the underlying risk of servicing consumer PAYGo loans for Solar Home Systems and its implications for financing options to support the market’s growth.

At the recent Unlocking Solar Capital conference in Kigali, Rwanda, CDC’s Geoff Manley helped launched the report during a roundtable of major market players. Addressing the challenge of financing the growth of the PAYGo industry, Geoff stressed that companies, investors and lenders need to better address loan servicing risk in order to fuel healthy and sustainable market growth.

Geoff said:

“These businesses have the chance to reduce the energy poverty gap, drive financial inclusion and improve quality of life for millions of people. But to do so, PAYGo companies need to reach scale, which will require large amounts of finance. Because servicing is so important to the success of these companies and their investors, the industry needs to put more effort into reducing this risk. For example, by developing back-up servicing plans. This will unlock more and better financing and significantly improve the whole industry’s prospects.”

Powering growth in Africa

CDC has a 70-year history as an investor and lender in African power and has directly or indirectly invested in a third of all utility-scale independent power producers in sub-Saharan Africa (outside South Africa). More recently, we’ve targeted investment into the off-grid solar sector to complement our grid-scale investments and have now invested, directly or through funds, in eight of the top 10 PAYGo solar companies in Africa, including M-KOPA, d.light and Greenlight Planet.

To support the growth of the sector, we have launched an Off-Grid Solar debt initiative to provide working capital to PAYGo solar companies. We believe that local currency debt financing is a critical gap in the market and are committed to making it available directly, in partnership with local banks or through specialist debt funds. We also promote strong environmental management standards and consumer protections. Through CDC Plus, our technical assistance facility funded by the UK’s Department for International Development, we are helping finance the development of industry-wide consumer protection principles under a program led by the Global Off-Grid Lighting Association, the global industry association.